The Fintech Revolution Summit, organized by Traicon Events, took place on August 2nd at the beautiful Dusit Thani Lakeview venue. This two-day event focused on Egypt’s future plans for advancing financial innovations, attracting industry leaders, experts, entrepreneurs, investors, government officials, and visionaries. Together, they delved into the vast realms of fintech, exploring emerging possibilities and trends that are reshaping the financial landscape.

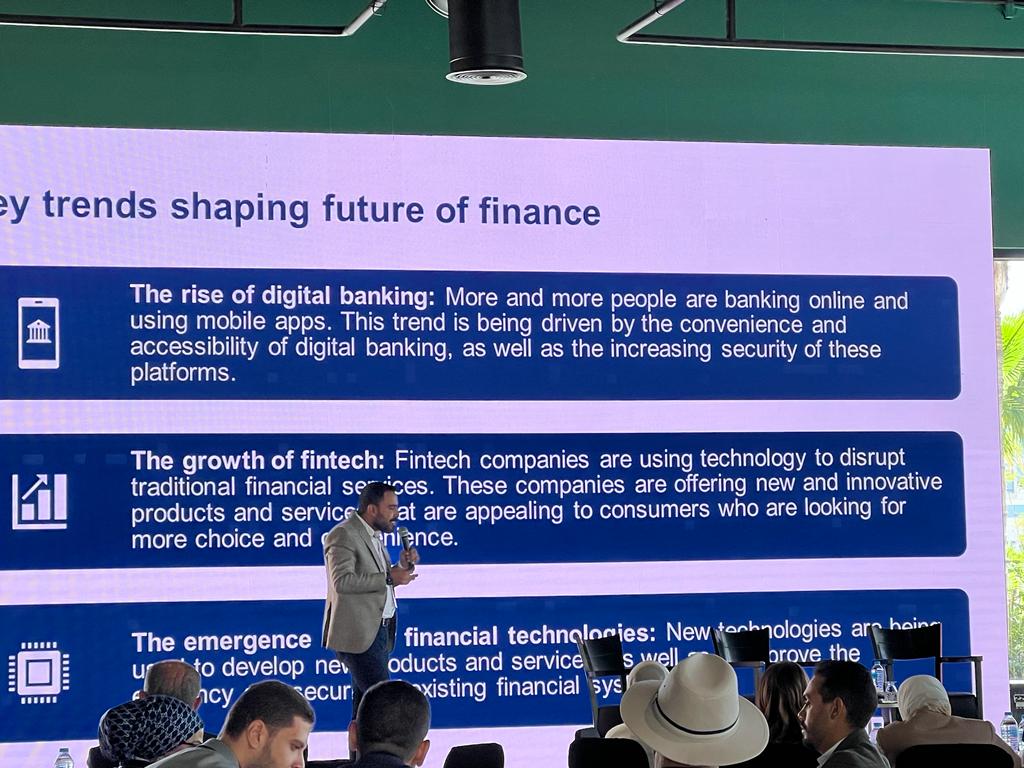

The summit highlighted Egypt’s potential to become a regional hub for fintech innovation and growth. It featured engaging keynote speeches and panel discussions led by subject experts from various industries. These sessions covered a wide range of topics, including digital payments, blockchain, AI, lending, and mobile banking. Additionally, the event provided a valuable platform for fintech startups and entrepreneurs to showcase their products and services. It actively promoted knowledge-sharing on adopting digital technologies to transform Egypt into a thriving fintech hub.

The venue itself, surrounded by lush greenery and panoramic glass walls, provided a visually stunning setting for the summit. The first day commenced with a warm welcome, followed by an insightful talk from Khaled Mostafa, the Permanent Undersecretary of the Ministry Of Planning And Economic Development. Mostafa emphasized the strategic importance of fintech for Egypt’s sustainable development. He stated that while Egypt’s Vision 2030 plan outlines the desired achievements, fintech plays a crucial role in determining the “how” of attaining those goals adding “Fintech jumps very high on the list.” Mostafa also highlighted the significant population of Egypt, accounting for 25% of the MENA region’s total population. Surprisingly, Egypt has 93 million active mobile subscriptions, with nearly half of them having internet access, roughly 46 million individuals. He viewed this as a solid foundation for leveraging technology to achieve sustainable development objectives.

The Egyptian government is committed to supporting and nurturing three main sectors: industry manufacturing, agriculture, and digital technology. Within the digital technology sector, fintech plays a significant role. Mostafa pointed out that 67% of the Egyptian population lacks access to any financial institution, underscoring the great potential of reaching them conveniently through Fintech. However, the complete digitalization of banking services comes with challenges. Not everyone is tech-savvy, literate, or has access to banking services. Despite this, Mostafa says “Egypt aims to digitalize 90% of documented services by 2030.”

Bahaa Farouk, the Head of Engineering at Bank Misr, further emphasized the importance of banks offering customers a seamless and portable banking experience. As went on to discuss optimizing user experience, creating digital solutions for privacy and fraud management, and integrating AI into banking operations.

Moreover, Parmod Veturi, CEO Of International Business at Perfios Solutions, shared his experience transitioning from a banking background to technology. He stressed the significance of integrating e-governments and digitalized services and transactions into the banking infrastructure. Veturi highlighted that “97% of transactions in Egypt still rely on paper,” revealing the need for transformation. Overcoming the language barrier, they successfully implemented an open-banking system with one of the banks in Egypt, translating digital documents to Arabic in less than six months. This achievement can serve as a blueprint for other banks as well.

Emad Kattara, CEO and Founder of the Banker’s Lounge, shed light on the role of youth in fintech. He shared the success story of ‘Insta Pay,’ an online payment service that originated from the collaboration of a group of young individuals with the Central Bank of Egypt. Kattara emphasized the importance of supporting youth and providing them with the necessary space to pitch innovative ideas, as they hold the key to shaping the future of fintech.

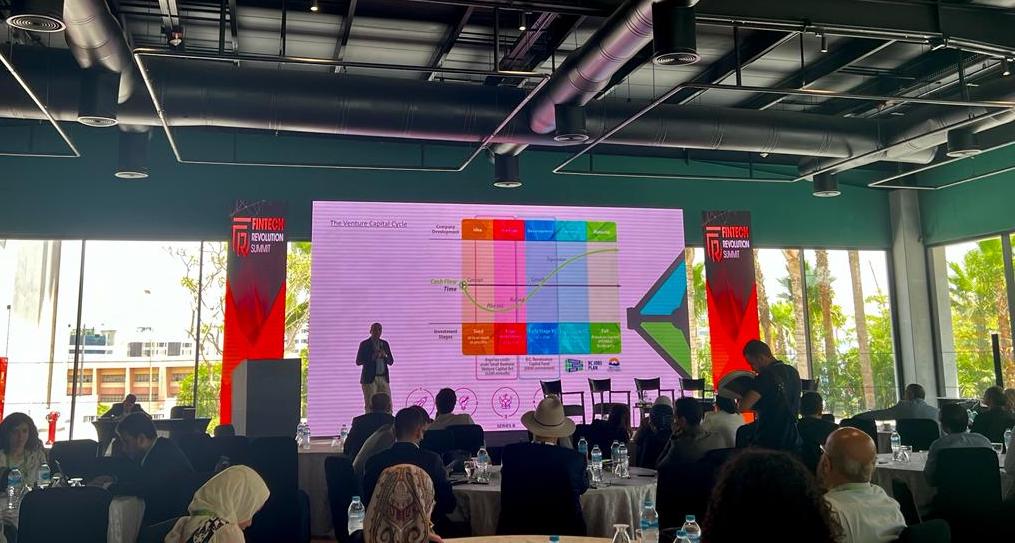

Maged Harby, General Manager of Edventures, unveiled the goals of Edventures as the first tech-focused corporate venture capital in the Middle East. This organization seeks to invest in ed-tech startups in the pre-seed and seed stages, focusing on education, culture, and innovative learning solutions.

The last speaker of the day was Azizjon Azimi, CEO of Zypl.ai, an AI-based credit scoring solution for financial and credit institutions. Azimi explained the concept of generative AI in the finance sector, which “involves simulating data under different macro-economic conditions. Zypl.ai utilizes synthetic data to build models that consider not only historical data but also provide simulations of how the data would respond to changes in inflation rates or other global factors like the current situation we are in.” Azimi adds that although the model cannot predict with 100% certainty, it can adapt quickly to evolving circumstances.

The future of Egypt in fintech looks bright, with a growing ecosystem, supportive regulatory environment, and increasing demand for digital solutions. The country has witnessed a fintech revolution in recent years, marked by the emergence of numerous startups and initiatives aimed at promoting financial inclusion and digital transformation. Mobile and digital payments have experienced a substantial surge, aided by the introduction of a national payments platform by the Central Bank of Egypt to simplify digital transactions, indicating the positive trajectory of Egypt’s fintech landscape.

WE SAID THIS: Don’t Miss…Egyptian FinTech Company, Halan Secures $400M In Funding