By: Sarah Alblowi

The future is cashless, in the best way. No more holding germ filed worn out, soft-cornered notes or having to do annoying math equations to collect rusty change.

Mobile wallets are the best user-friendly method of payment, with a swipe, a scroll you can pay for dinner, groceries, new sneakers or a taxi. How convenient is having your cash app next your Instagram, Emails and Google Maps?

No more “I forgot my wallet” excuses! We all can’t survive without our phones, so your wallet is always attached to you. Thankfully, you don’t have to worry about losing your credit card and running to the bank for annoying procedures. In fact, how about we ditch fat wallets? No cash, no IDs, no cash, no problem!

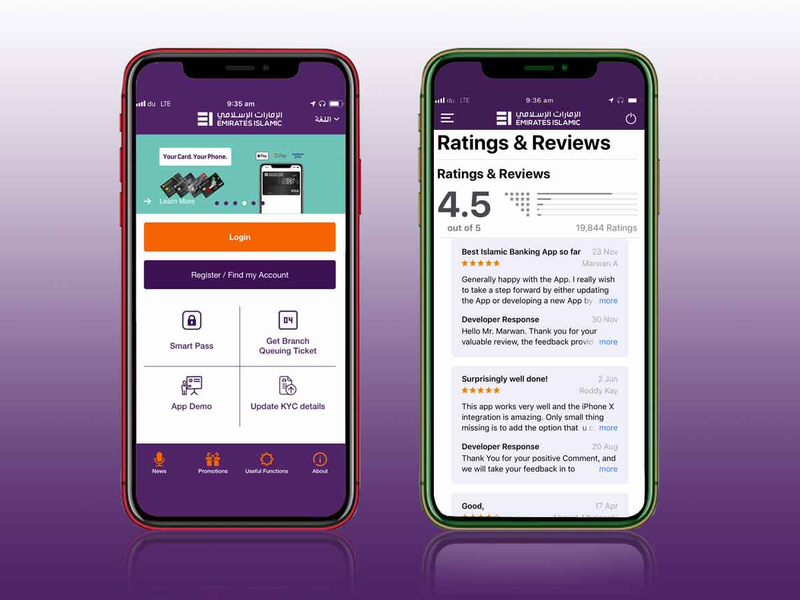

The popularity of mobile wallets is growing in the UAE. Emirates Islamic is the first to launch a cashless mobile wallet app, and it’s rapidly gaining popularity with the locals.

According to Gulf News, the app already earned 4.5 stars by 17,000 reviews. Besides the security, the app carries easy access features like cardless ATM withdrawals. This economic movement is expected to hit 2.2 billion by 2030.

We hope soon enough, the Middle east will follow these cashless footsteps. Virtual coins have countless benefits from reducing risk to saving time, which have been proven in practicing countries like the US and China. Anything from renting a bike to buying a piece of fruit, is an online hassle -free purchase.

Plastic credit and debit cards are also becoming a thing of the past. An era of affordable smartphones and free Wifi, why bother? Smartphones are dominating the market and it’s becoming the new norm. Virtual payment options offer solutions to every problem. Before we know it, our kids won’t be comprehending the fact that we carried bulky leather wallets.