Bahrain-based GFH Financial Group has made headlines with its latest $300 million acquisition in the United States’ student housing market. With this purchase, GFH Partners, the asset management arm of the group, expands its US student housing portfolio to over 5,500 beds and a total value of $900 million.

According to Pramod Kumar (Nov. 25, 2024), the acquisition highlights the growing interest Gulf investors have in this burgeoning sector.

Why US Student Housing is Attracting Gulf Investment

Demand for student housing in the US has skyrocketed due to significant demand-supply imbalances in public universities with large enrollments and strong academic programs.

GFH’s newly acquired properties boast a 99% occupancy rate and are strategically located near major universities with enrollments exceeding 30,000 students. These include:

• University of North Texas: Two assets with 859 beds.

• University of Kentucky: A 649-bed property.

• University of Tennessee: A development project to deliver 605 beds by 2026.

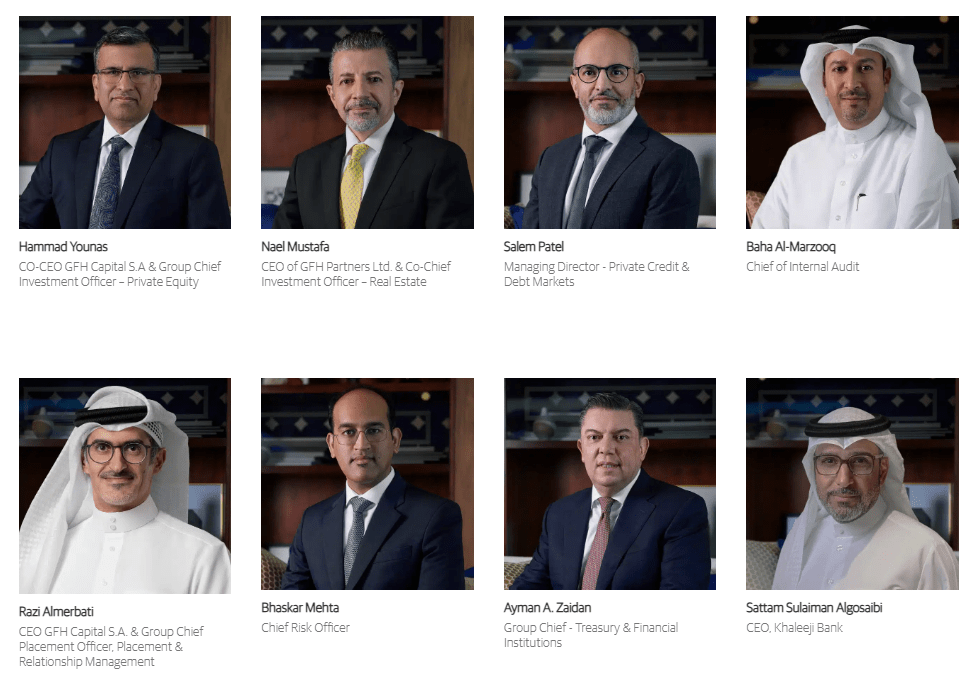

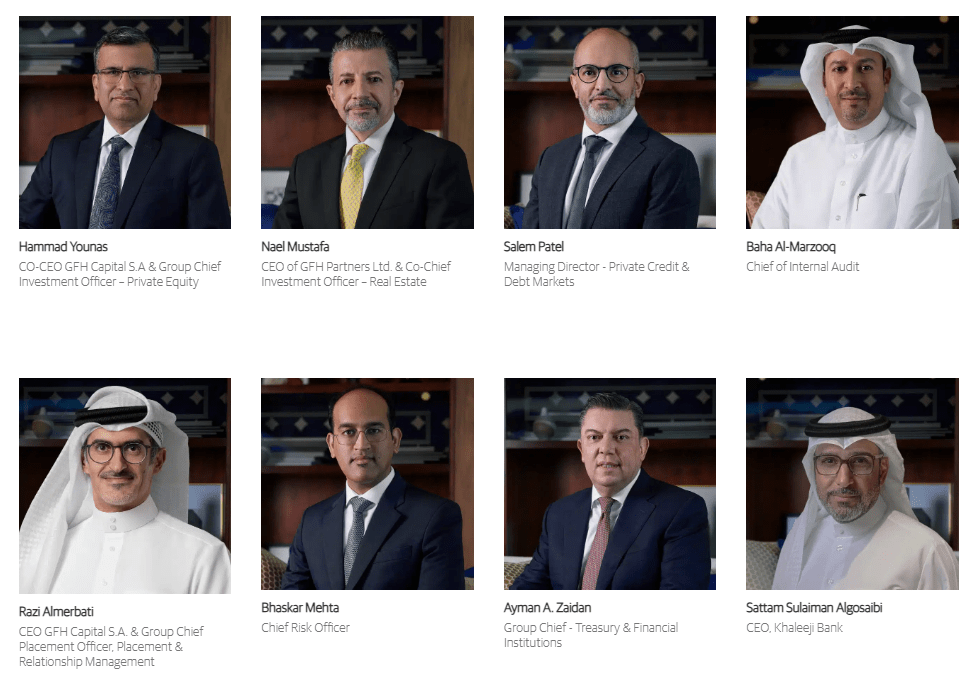

Nael Mustafa, CEO of GFH Partners, emphasized that these investments target locations where public universities face a shortage of on-campus housing for students, creating a sustainable demand for private student accommodation.

What Sets GFH’s Strategy Apart?

GFH Partners collaborates with prominent US operators such as SQ Asset Management and Vesper Holdings, who manage over 15,000 and 30,000 beds, respectively. This partnership ensures that the properties are professionally managed to meet the needs of students and maintain high occupancy rates.

In a note posted earlier this year, GFH highlighted that the US student housing market has yet to fully mature in terms of supply, leaving significant room for growth.

With 15 million students enrolled in US universities annually, along with over one million international students, the market remains a lucrative opportunity for investors.

The Broader Trend of Gulf Investment in Education

GFH’s move is part of a larger trend of Gulf entities investing in the US education sector, with billions already funneled into student housing over the past few years.

However, the interest doesn’t stop at international markets. According to a report by AGBI (September 2024), Gulf investors are now eyeing opportunities to replicate these investments locally within the region.

By diversifying their portfolios across global and regional markets, entities like GFH aim to capitalize on stable returns from the education sector while meeting the increasing demand for quality student housing solutions.

What Does This Mean for the Future?

As Gulf investments in the US student housing market continue to rise, questions remain about how this trend will shape the sector both internationally and within the MENA region.

Will Gulf-based universities soon adopt similar private housing models to address their own demand-supply challenges? For now, GFH’s $300 million investment cements its role as a key player in this evolving market.

WE SAID THIS: Don’t Miss…EFG Hermes Launches $300 Million Saudi Education Fund to Support Vision 2030