Securities fraud occurs when individuals or companies deceive investors by providing false or misleading information about investments. Such conduct can lead to significant financial losses and damage trust in financial markets.

The United States Sentencing Commission says that 91.5% of individuals sentenced for securities and investment fraud were men and 92.0% of them were American citizens. To protect your finances from fraud, you must know about laws when investing in stocks.

A key legal provision addressing fraud is the securities fraud statute, such as 18 U.S.C. § 1348, which makes it a crime to knowingly execute, or attempt to execute, a scheme to defraud someone in connection with securities or commodities. In New York, the Martin Act grants the attorney general broad authority to pursue suspected securities fraud crimes in the state.

Let’s take a look at some important facts that every investor should know.

Overview of Securities Fraud

Securities fraud primarily refers to the actions or omissions of individuals or companies that mislead investors by withholding important information about the products they finance. Fraud may take different forms: through altered financial statements, illegal insider trading, and pump and dump schemes.

Bank fraudsters, promising large returns without risk, can deceive investors, causing them to lose millions of dollars. According to white-collar crime lawyer Donald P. Day, securities fraud is a type of white-collar crime, which carries significant and life-altering penalties.

You need to be able to identify the signs of securities fraud before you fall victim and lose your protected assets. Research and consult professionals if you sense something is off.

Key Legal Provisions and Statutes

There are many legal provisions and statutes available for the safety of investors against fraud and the sanctity of the market.

As per the Securities Act of 1933, the companies are required to give sufficient legal disclosures in their securities offerings before making an investment decision at the individual level.

The Securities Exchange Act of 1934 governs and regulates trading as well as creating rules under which manipulation or deception is prohibited. Under Section 10(b) of the Exchange Act and Rule 10b-5, it protects against manipulative or fraudulent acts with respect to the purchase or sale of securities.

The Sarbanes-Oxley Act of 2002 therefore provided for heavy fines and prison terms for corporate fraud, establishing confidence in financial reporting.

Various other state laws also fall under the Blue Sky Laws. Understanding these statutes will help in knowing the available rights and remedies suitable for fraud.

Common Types of Securities Fraud

Fraudulent schemes can take an array of different forms, all detrimental to your financial welfare. The first act could be illegal insider trading, whereby someone has traded based on non-public information to make profits.

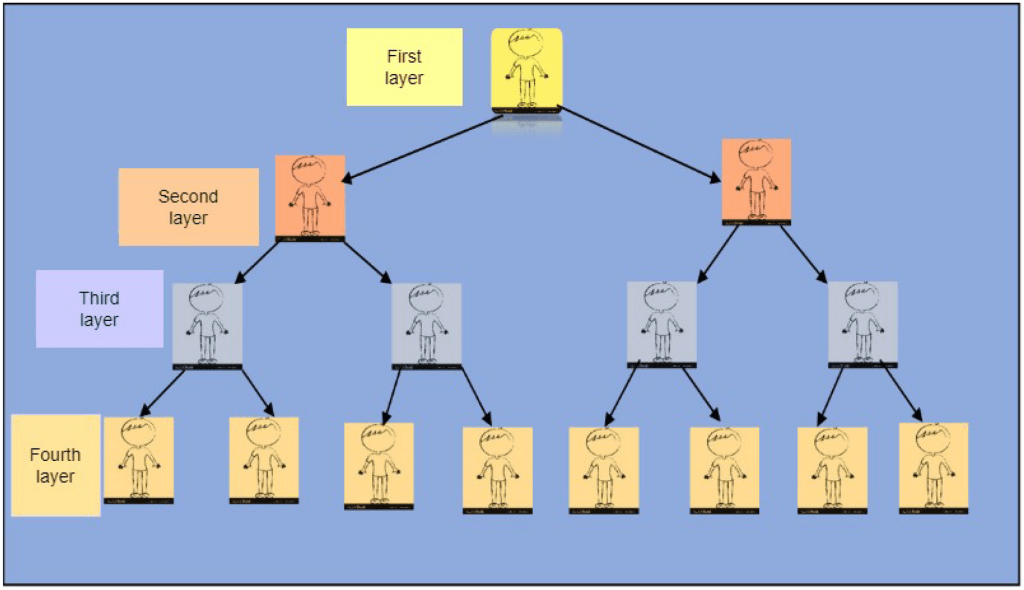

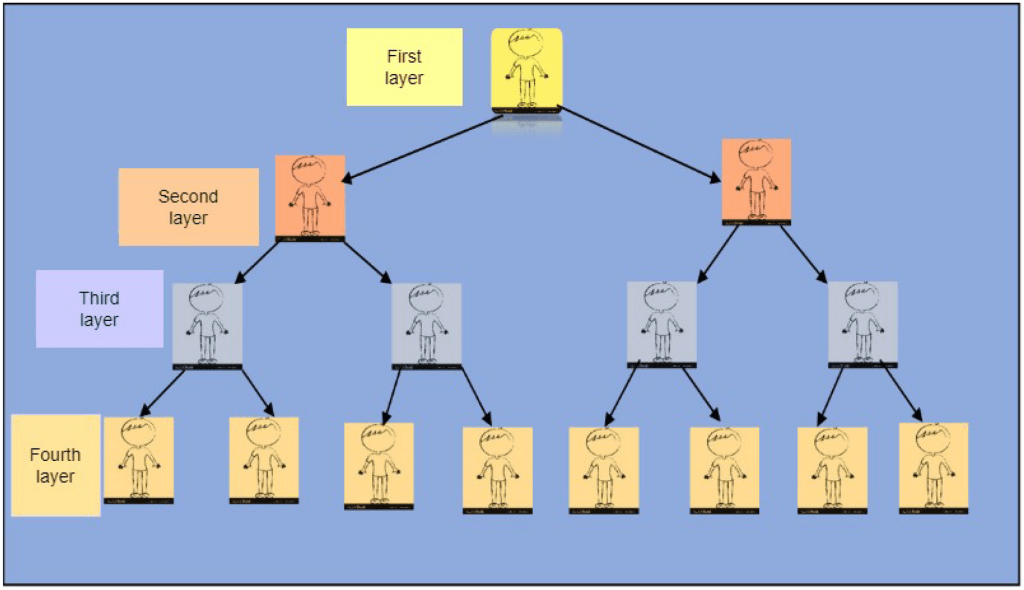

Another is the Ponzi scheme, which promises existing investors high returns with the money collected from new investors rather than the profit made by a legitimate business operation.

Another one is the pump-and-dump scheme, where the criminals disseminate false information to drive the price of a company’s stock up and sell their shares at a profit, almost wiping out the remaining shareholders.

Misrepresentation signals the opposite; it tries to entice investors with false data regarding the company’s fiscal condition. An informed investor can avoid these types of securities fraud by knowing what to look for.

Consequences and Penalties

Securities fraud entails dire repercussions that can adversely affect your financial future and reputation. The penalties may comprise enormous fines, often in the millions of dollars, and the possibility of several years of imprisonment.

Any public company may bar you from serving as an officer or director. Civil lawsuits filed by investors may add to your burden, as they seek damages for losses that have arisen out of your fraudulent conduct.

Your profession would undoubtedly stigmatize you, making future financial jobs difficult to secure. Once you’ve completed your term, it could be challenging to demonstrate your trustworthiness to prospective employers and clients, potentially damaging your career.

Protecting Yourself From Securities Fraud

For securities fraud protection, the first rule is to make investment decisions as well-informed and careful as possible. Always investigate companies and their financial statements from time to time before you invest.

You may be in danger if the company uses high-pressure sales techniques or makes unsolicited offers. Contact the SEC and other regulators to check they are legitimate.

Diversification is a key strategy that can reduce your level of risk. Trust your instincts: if it appears too good to be true, then it most probably is!

Maintain a record of your transactions and communications regarding your investments. Regularly check your investment statement against your records for any discrepancies. Contact a financial advisor if you have any doubts regarding investment. Taking these preventive actions may safeguard your assets from possible fraud.

WE SAID THIS: Don’t Miss…How To Secure Yourself From Fraudsters: Insights From Cybersecurity Expert Abeer Khedr