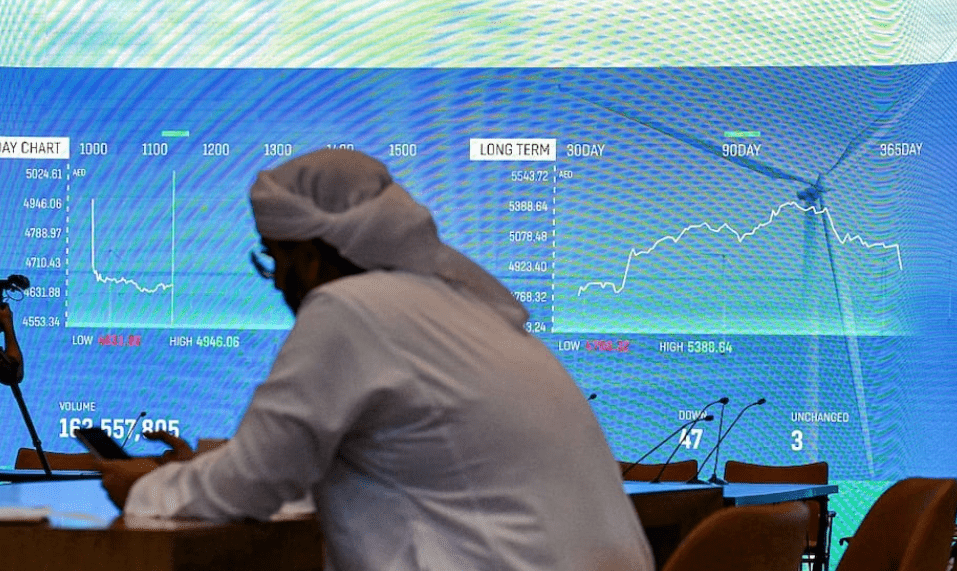

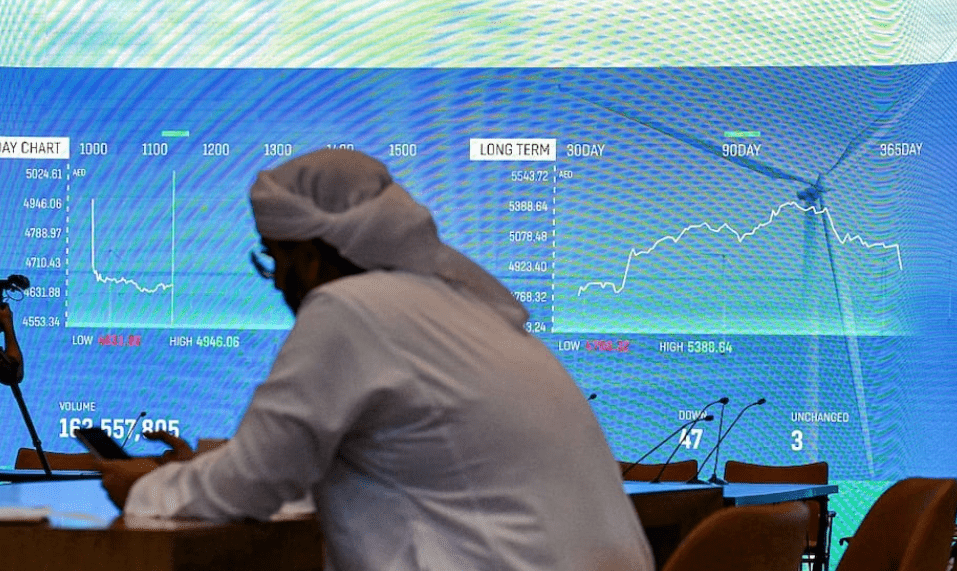

On April 5, the U.S. imposed new tariffs on goods from several countries, triggering significant declines across global markets. According to Times Union, the Middle East, particularly the Saudi Arabian stock market, was notably affected. Saudi Arabia’s stock market (Tadawul) experienced its largest drop in over a year, shedding billions in market value in just one day.

Major Losses in Saudi Arabia’s Stock Market

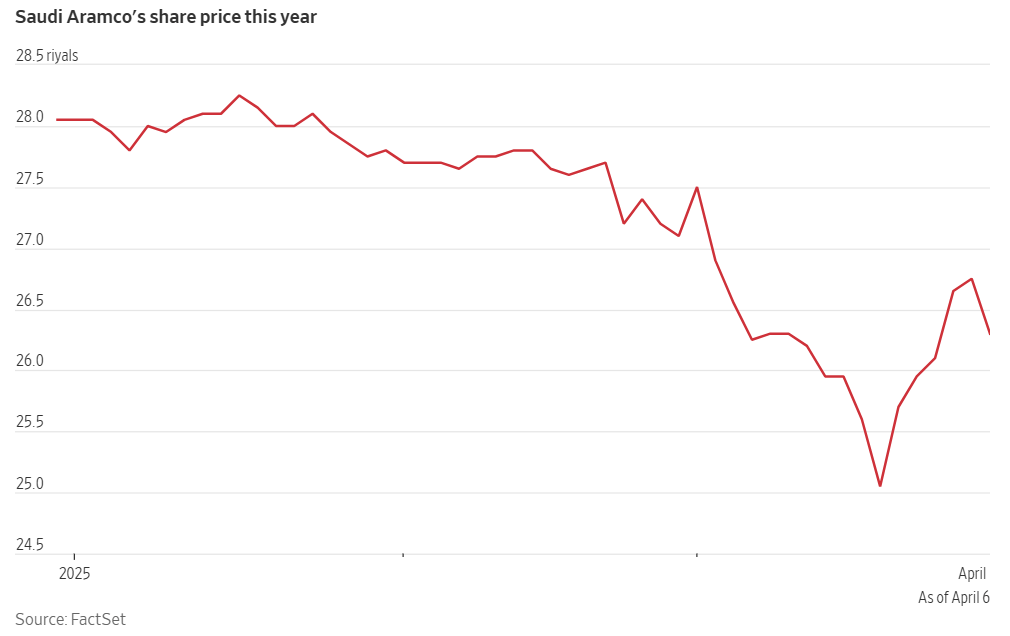

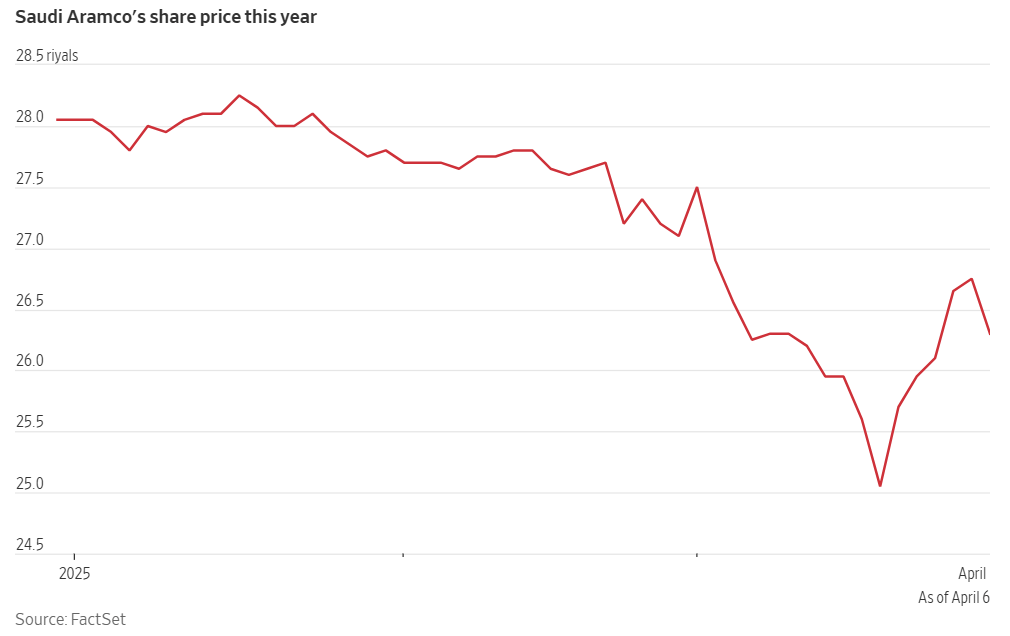

The biggest shock came from Saudi Aramco, the world’s largest oil company. Aramco’s market value dropped by $11 billion, with shares falling by 5.3%. Overall, the Saudi stock market plunged 6.78%, marking the most significant single-day drop since the pandemic’s peak in 2020. According to market experts, the sudden decline was directly tied to the global economic uncertainty triggered by the U.S. tariffs.

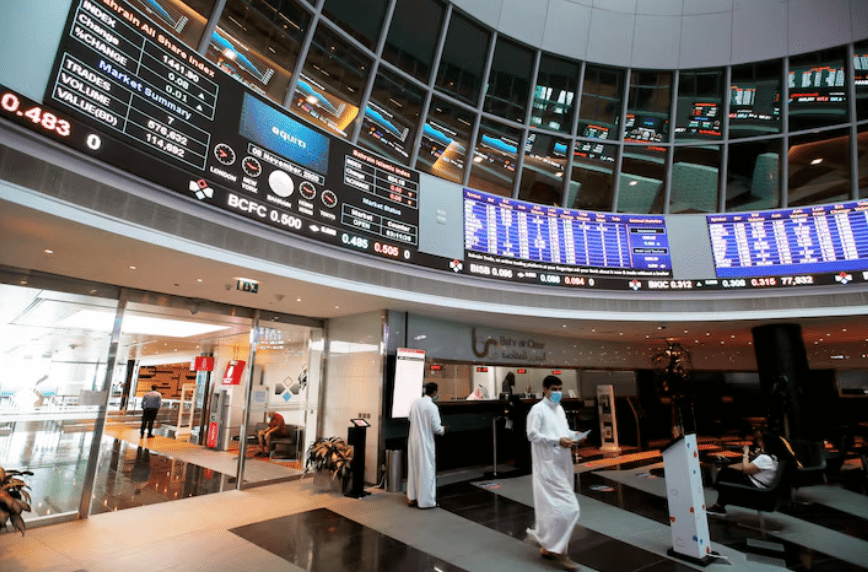

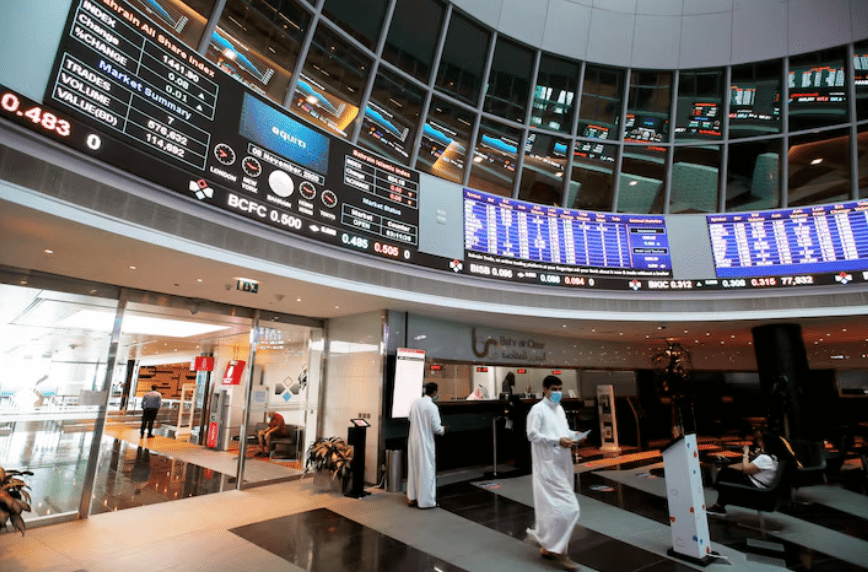

Impact on Dubai and Abu Dhabi Markets

The repercussions of the tariffs also rippled through the UAE markets. AP News reports that on the same day, Dubai’s stock market recorded a 5% drop, with prominent companies like Emaar Properties seeing a nearly 9% fall in value. In Abu Dhabi, the stock market experienced a 4% decline.

Impact of Oil Price Decline on MENA Markets

Oil prices, which are crucial for MENA economies, have been affected as well. Reuters reports a 3% decline in oil prices, driven by fears that escalating trade tensions could reduce global demand for crude oil. This has raised major concerns for oil-dependent economies in the region. Additionally, Brent crude has fallen nearly 15% over the past week alone, according to the Associated Press, exacerbating the economic uncertainty in the Gulf and broader MENA markets.

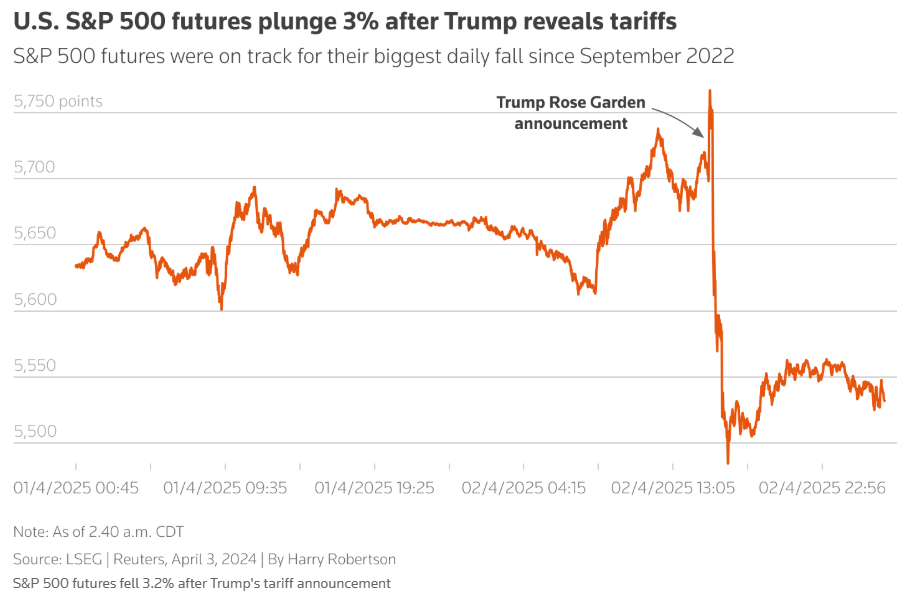

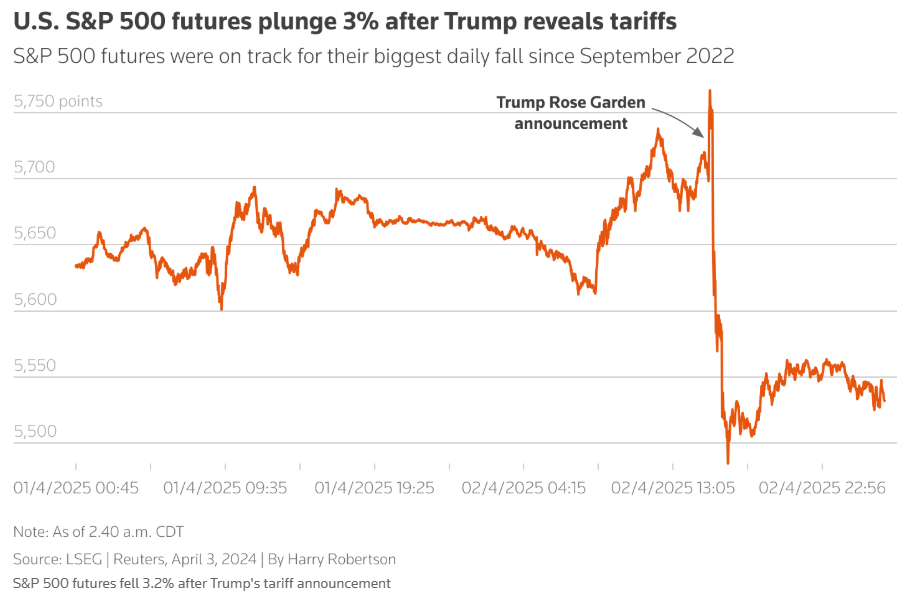

Broader Market Impacts

These new tariffs have had a domino effect on stock markets worldwide, acccording to Market Watch. U.S. indexes such as the S&P 500 and Nasdaq Composite also saw notable losses, highlighting how global trade policies continue to influence economic stability.

What’s Next for MENA Markets?

As of now, analysts are monitoring how long the effects of these tariffs will last. The MENA region, which is heavily dependent on oil exports and global trade, will likely face continued market volatility. Governments and financial institutions in the region are expected to respond with measures aimed at stabilizing the economy and protecting investor confidence.

WE SAID THIS: Don’t Miss… Your Ultimate Guide to April’s Top Concerts Across the Middle East