In today’s dynamic business environment, adopting a diverse payment system isn’t just a trend. It’s a business strategy essential to financial success. Besides convenience, it’s a strategic move that meets and serves changing customer demands and boosts financial stability. A business that understands and implements lots of payment options shows they’re customer-centric. It helps businesses break into new markets and improves consumer satisfaction.

In this comprehensive guide, we correlate expanding the payment option with the financial success of the enterprise. We assert how a versatile payment system transcends beyond a technological tool, rather it is a marketing and financial strategy at the core.

The Rise of Consumer-Centric Payment Solutions

Offering a range of payment options is vital in a world where customer preferences drive business strategy. Tailoring payment solutions to customer needs improves the shopping experience. This ultimately makes customers more loyal. A seamless transaction journey is the objective of payment diversity. Meeting customer demands with appropriate payment options facilitates transactions. It also fosters a long-term relationship with them. To foster loyal customers and drive consistent revenue streams, businesses need to adapt to these preferences.

Expanding Market Reach with Payment Flexibility

The goal is to help businesses reach more customers by incorporating multiple payment options. You can boost your business’s market share by using payment methods popular in different regions or among different demographic groups. This breaks down barriers and makes products more accessible to more people. Equipped with diverse payment options, the business attracts a broader customer base and is positioned as an inclusive global company.

Streamlining Operations and Reducing Costs

A versatile payment system can cut costs and help your business run more efficiently. It streamlines business processes, cuts transaction costs, and minimizes financial risks by integrating multiple payment methods. Diversifying payment options will help businesses reduce risks associated with reliance on a single payment option. It also maintains a lean and agile operation. Strategic approaches lead to more robust financial operations that can withstand market fluctuations and technology changes.

Boosting Sales through Payment Convenience

A convenient payment option boosts sales. It boosts customer convenience, resulting in more sales. Businesses with convenient payment options will have higher sales. The idea is to make it easy for customers to get their purchases done at checkout. Besides catering to their preferences, this approach encourages impulse purchases and big buys. This strategy is as effective as offering discount deals like nike discount code.

Enhancing Security and Trust with Diverse Payment Methods

A versatile payment system can enhance security and build trust. Both businesses and consumers care about security in transactions. Providing secure and diverse payment options reassures customers, which leads to stronger relationships and brand loyalty. Security in payment methods isn’t just about protecting transactions; it’s about creating a safe shopping environment. It builds customer trust and makes your business stand out in a competitive market.

Leveraging Technology for Payment Innovation

Payment systems and technology intersect to create unparalleled innovations. Having cutting-edge payment technologies shows you’re keeping up with the times. Tech-savvy consumers love this approach. It also positions the company as forward-thinking. It imparts agility, efficiency, and robustness to the business.

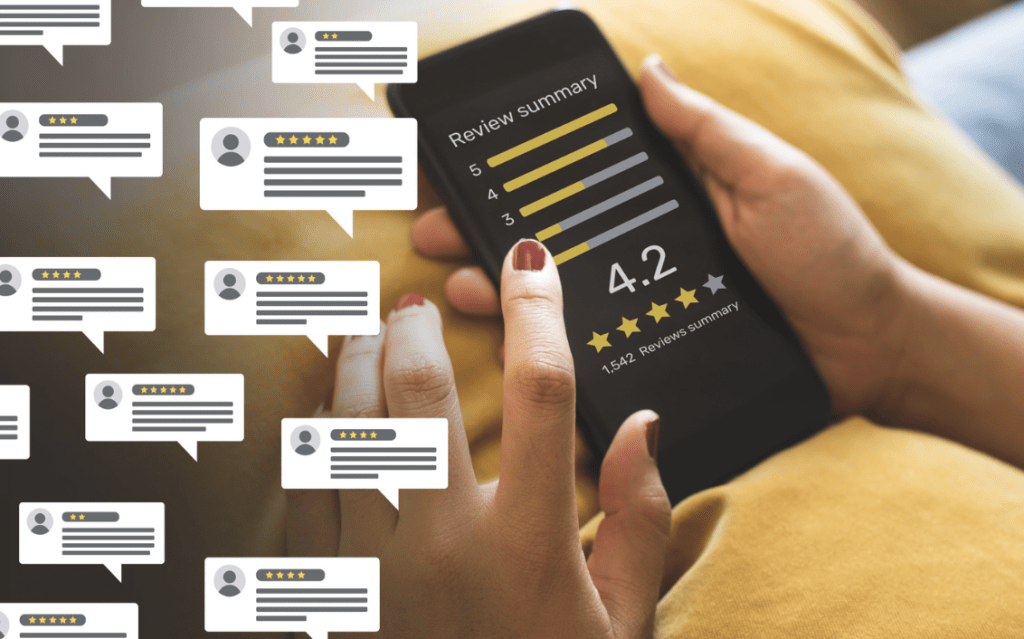

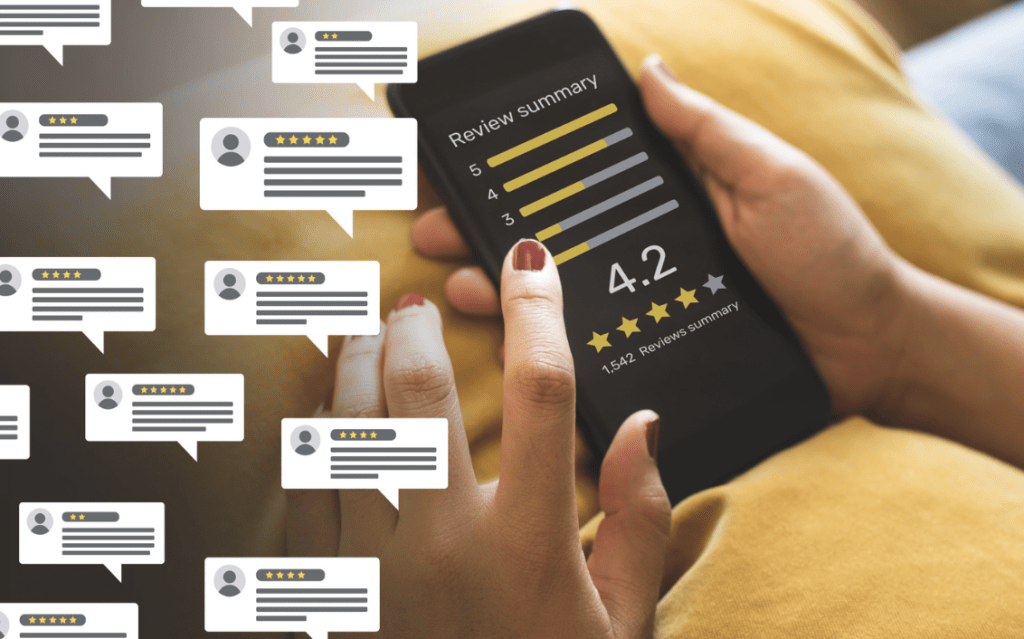

Analyzing Data for Strategic Decision-Making

Using payment data to gain insight into consumer behavior and market trends is a goldmine for businesses. By analyzing payment data, businesses can identify patterns, preferences, and areas for growth. This information is crucial for making informed strategic decisions and tailoring offerings to meet customer needs. Businesses can stay ahead of market trends with this data-driven approach. Business analytics increases engagement and boosts the conversion rate of mass marketing campaigns like payment options on black friday.

Adapting to Global Trends and Expectations

A versatile payment system can help businesses meet global standards and expectations in a globalized economy. The best way for businesses to come by international customers is to offer payment options popular in different countries. It’s crucial for businesses looking to expand beyond local markets to be able to adapt to global payment trends. Convenience and trust are two pillars of transactions across borders. Businesses need to employ diverse payment methods to make the transaction happen.

The Future of Business Lies in Payment Versatility

A versatile payment system is worth it financially. Adapting to different payment methods isn’t just about accommodating them. You’ve got to embrace a strategy that fits customer preferences, technological advances, and global market trends. This versatile approach leads to financial growth, customer loyalty, and a strong market position for businesses that adapt. In an ever-evolving market, integrating multiple payment methods will be a big driver of business success.

WE SAID THIS: Don’t Miss…5 Ultimate Reasons Why You Must Have A Bank Account In The UAE