Bringing a semblance of hope amidst the ongoing Gaza genocide, McDonald’s CEO Chris Kempczinski spoke up about how several markets in the Middle East are experiencing a “meaningful business impact” because of the Gaza war.

The fast food franchise’s business in the Middle East has been hurt by boycotts carried out in protest of the company’s support for Israel. This started when it was revealed that McDonald’s was offering free meals to Israeli soldiers after the October 7th events.

McDonald’s Major Hit In Sales

Since then, the Boycott, Divestment and Sanctions (BDS) movement, which is known as a grassroots campaign that lists all the companies that need to be boycotted and why, has categorized McDonald’s as an “organic boycott target.” This categorization stems from the company’s direct profit from the killing of Palestinians.

When looking at the numbers, the company has seen a major decline in its sales in Egypt, which decreased by 70% in October and November compared to its sales numbers in the same months last year.

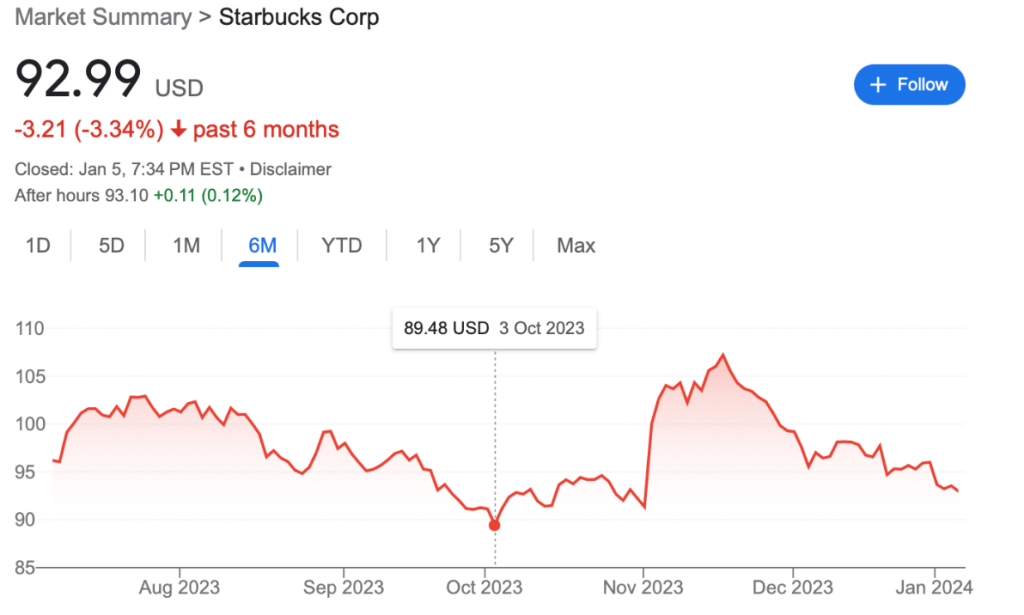

A Timeline Of Stock Prices

In addition to McDonald’s, many other brands faced a similar loss of profit because of the ongoing boycott. In mid-October, Starbucks and Disney also saw a drop in their stock prices for three days in a row.

While McDonald’s stock dropped by -0.43% to a value of $257.00, Starbucks slipped by -0.44% to a value of $94.19, and Disney fell by -0.40% to a value of $82.32.

The lowest stock price that McDonald’s reached was $246.19, which was on day 11 of the genocide when the attacks were still fresh in the minds of the globe.

Similarly, Starbucks faced a major decrease in stock prices, especially in October, with its lowest stock price being $89.48. Stock prices did rise again for Starbucks during November, with the highest price being $107.21 during day 40 of the genocide, but dropped once again during December and January.

Disney also saw a major dip in stock prices during October and November, with its lowest stock price being $79.32 in early October, but the stock prices increased in December and January, going as high as $96.06.

Even if the stock prices haven’t taken a major hit for some companies, these franchises are losing sales in many Middle Eastern countries, including Egypt, meaning that there’s an impact.