Now that I’m 21, I’ve taken the decision that I need to be (at least) largely independent from my parents when it comes to my expenses. Since then, I started noticing how recklessly and unknowingly you could spend while thinking that you’re paying just a few pounds.

And I’m not even talking about the big things like having an apartment, or stocking the fridge with food, or buying clothes, because my parents still provide me with all of that.

I’m talking about (mostly) the little things. Some of those things may seem to account for an almost negligible amount of expenditure at first, but when added up, they will solve the mystery of where your monthly allowance/salary is flying off to every month.

Now, to make it clear from the start, I am not, by any means, talking about the majority of the Egyptian population. There is no way for me to even imagine the struggles of what most of us Egyptians go through everyday.

However, if you’re a young person in Cairo who makes a certain amount of money or receives a certain allowance, these are probably the things that eat up your money the most, slowly and steadily:

The daily trip to the koshk: 150 LE

If you buy one can of Pepsi every day for one month, that’s 90 pounds GONE. If you buy one bottle of water every day, that’s 75 pounds GONE.

In short, it might not seem like a huge sum of money to lose, but you will know their true value when you need to fill up your car one last time this month because you drove it all the way from Tagamo3 to Zamalek then back home to Heliopolis.

What you can do about it: Refill your water bottle at home, work or the university instead of buying a new one every day. Cut back on the soda, the candy, the chips and the junk they sell at koshks. It’s bad for us, anyway.

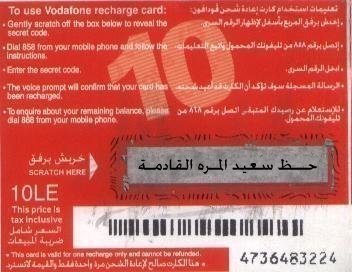

Credit: 150 LE

And this is just if you’re one of the lucky single folks. If you’re part of a couple, expect that amount to be multiplied at least five times.

What you can do about it: WhatsApp instead of texting. Text instead of calling. Call when you really need to discuss something in detail. Get more face-to-face time with the people in your lives.

Gas: 500 LE

Gas makes up a huge part of my monthly expenditure because I drive mainly long distances and I usually hit many places scattered all around the city in one day. I’m sure anyone who owns a car would be in a similar situation, given that driving takes up pretty much 25 percent of any Cairene’s life.

What you can do about it: Skip the unnecessary appointments or the outings that you only kind of want to be a part of (especially when the outings in question are in Mohandessin and you live in Tagamo3).

Carpool with one of your friends. Walk more. Use the metro if you’re going somewhere that has a station nearby.

Ordering in/Dining out: 1500+ LE

We’ve already established that dining out in Egypt has become a joke recently, so why spend most of our paycheck on it? Think of every mediocre meal you’ve had or every one you had just out of tafasa.

Now think of the money you could’ve saved throughout the months and used instead to pay for a new car’s installment or an awesome vacation, perhaps.

What you can do about it: Eat homemade food. Cook your own meals. There’s a great amount of pleasure in doing so. Pack lunch to work. God knows that’s ten times healthier than anything you order.

Try to limit your orders/dining outings to when you’re really craving something that you can’t make yourself, when it’s a special occasion, or when you want to treat yourself to something after a long day.

Cigarettes: 600 LE

This hugely depends on how big of a smoker you are and what type of cigarettes you prefer.

Now, putting aside that smoking is a disgusting habit and it’s bad for you in every single way, 600 LE is a handsome amount of money to fork out every month if you’re a young person trying to stand on your own feet in this country.

What you can do about it: Stop. Just stop. I’m sorry. I mean, just try to quit or at least cut back a little. Please?

Daily coffee: 600 LE

Yes, yes, yes, some people do spend that much on a cup of coffee each month. When you realize how much all the Frappucinos you drink add up to, you will decide to cut back at once.

And if you think that you’re saving the three minutes you would’ve spent if you had made your own coffee at home, try calculating the time you spend trying to find a parking spot, starting your car, waiting for the barrista to finish your order and arguing with the sayes on your way off.

What you can do about it: Get a good coffee blend from any coffee shop and make your own cup at home. A cup of good ol’ Egyptian style Nescafe never hurt anyone, either.

Impulse shopping: a damaging sum of money

There’s no way to get a rough estimate on the disastrous amounts of money one can spend in this situation.

It happens as a celebratory act in the midst of all the glory of payday. It happens when you see anything that says SALE on it. It happens when you’re frustrated. It happens when you’re bored. It happens when you need something last minute.

What you can do about it: Next time you feel frustrated and decide to take it out on your paycheck, think about how many times you’re actually going to use whatever you want to buy.

Take a moment and really think about it. You’d be surprised at how much less you impulse buy when you take whether you actually need an item into consideration.

Saying yes to every party/event/outing: more damaging sums of money

Nobody wants to be The Blitz. Nobody wants to miss out on the chance of having fun. But if you really think about it, you’ll find that you could’ve passed on at least half of those invites and you would’ve been perfectly happy in your pajamas at home, reading a good book or getting some much needed sleep.

What you can do about it: Well, say no more, obviously. Just think about if you can really afford to spend another 100 LE for a shisha and a lousy drink at the same cafe you hang out at, with the same people, telling the same stories, every single day.

I’m not going to go on about what you could do with the money you save if you watch what you’re spending a little bit more. Saving up, taking extra classes, renting your own apartment, buying your own car and traveling are just a few things off the top of my head.

I’m sure everyone has their own bucket list of things to do if they had a million dollars in the bank. It’s not going to be a million dollars, but saving up little by little makes a difference in the way you operate as a young adult. If not anything else, it gives you a beautifully odd sense of security and accomplishment.

Finally, think about giving a part of the money you save at the end of each month to someone truly in need. God knows our country is filled with people for whom a single pound makes a difference. I think in a country like Egypt, where more than 30 percent of the population live under the poverty line, this should be considered more of a national and humanly duty than a good deed.

WE SAID THIS: Don’t miss The Cost of Getting Married in Egyptt.