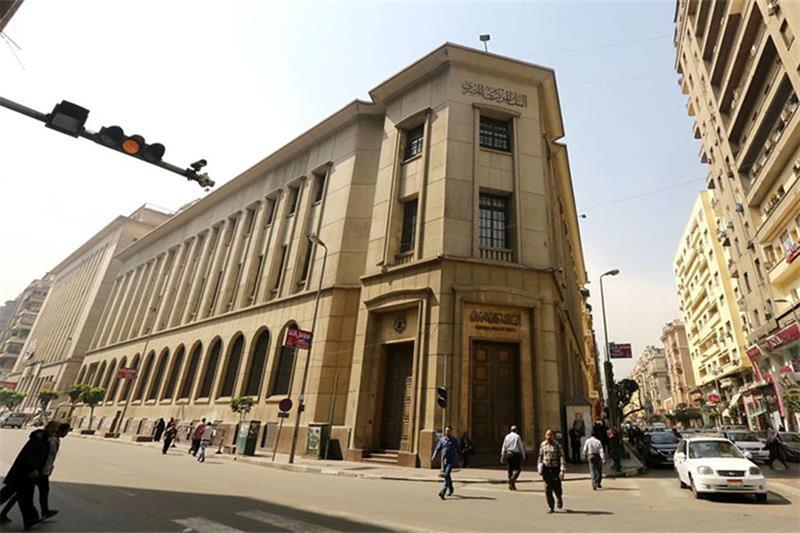

Following meetings between Egyptian officials and the International Monetary Fund (IMF) on the sidelines of the annual meeting of the World Bank and IMF and the announcement of a preliminary agreement, the IMF officiated a new loan program on Thursday, October 27th. Although the exact details of the agreement are yet to be released, the IMF announced that it would provide 3 billion US dollars over 46 months. The news came shortly following the Egyptian pound slipping to a record 23.9 to the US dollar and the Central Bank of Egypt raising interest rates by 2% the same day.

After seven months of on-and-off negotiations, the announcement of the loan agreement will come to the relief of many government officials and Egyptian businesspeople; however, the 3 billion US dollars falls below the 5 billion US dollars some had hoped for, according to Reuters. While details are still unclear, Finance Minister Mohamed Maait has publicly indicated in the past the IMF negotiators only had demanded in terms of the exchange rate flexibility of the Egyptian pound, and that they had made no major demands with respect to the budget or subsidiary program.

Gerry Rice, fund communications director for the IMF, released a statement before the agreement was formalized in which he stated that the two sides have proposed a “continued fiscal consolidation path that will safeguard public debt sustainability and ensure a steady decline of the debt-to-GDP ratio over the medium term.” However, in a nod to a potentially different approach by the IMF in regard to subsidies, which historically have been a point of contention between the Egyptian government and the IMF, Rice spoke of “Additional fiscal and related structural policies that would further expand the social safety net for the most vulnerable, improve the budget composition, and enhance fiscal transparency.”

Rice also made reference to Egypt’s struggles with inflation, which earlier this month reached a record high of 15%, and how the proposed agreement between the IMF and Egypt would tackle this. He described how the preliminary plan to support the economy would involve “Monetary and exchange rate policies that would anchor inflation expectations, improve monetary policy transmission, improve the functioning of the foreign exchange market, and bolster Egypt’s external resilience. This would enable Egypt to gradually and sustainably rebuild foreign reserves.” However, notably absent was any suggestion by Rice on what these “monetary and exchange rate policies” will entail exactly. Importantly, this agreement between IMF and Egyptian officials comes amid growing calls by financial markets for a further sudden devaluation of the economy to stave off inflation and bring Egypt’s trade deficit to a more productive level. The IMF has long insisted on Egypt taking a more flexible approach to the valuation of its currency on the foreign exchange market, and while the details of the agreement have not been released, Finance Minister Mohamed has signaled in recent television interviews that he believes the current policy of a stable foreign exchange rate to be damaging to the economy as a whole. Adopting a flexible foreign exchange rate would signal a qualitative change in the direction of Egypt’s economy by abandoning its long-held position of exchange rate stabilization. It is understood that the Egyptian pound slipping 13% today to 22.75 to one US dollar is part of this policy of promoting a foreign exchange value to better attract investment and reflect the real value of the currency.

Rice went on to seemingly reference some sort of potential resolution to long-standing disagreements between the IMF and the Egyptian government regarding the involvement of the state in the economy. Several commentators have maintained that the IMF’s opposition to the heavy involvement of state-aligned companies in the national economy has been a major roadblock preventing any agreement on a potential IMF loan for the cash-short economy in addition to allegations that the national currency was overvalued. However, Rice in his statement spoke positively of how the proposed “implementation of the authorities’ comprehensive structural reform agenda would gradually enhance the competitiveness of the economy, reduce the role of the state in the economy, level the playing field for the private sector, improve the business climate.” Reflecting the wider green agenda that is actively being incorporated into the working of international financial institutions like the IMF and being proposed as an integral component to economic development, Rice also mentioned the intention of the preliminary agreement to “foster transition towards a greener economy.”

News of the agreement is expected to calm the markets following a turbulent period in which consumer inflation reached a four-year high of 15% in September and an underwhelming post-COVID-19 economic boom along with the Russian invasion of Ukraine increasingly straining the national economy. Additionally, due to international markets rallying around an increasingly strong US dollar, Egypt much like many other low- and middle-income countries have similarly seen their national currencies slipping to record lows against the greenback.

WE SAID THIS: Don’t Miss… Persevering Through Crises: The Middle East’s Economy Examined