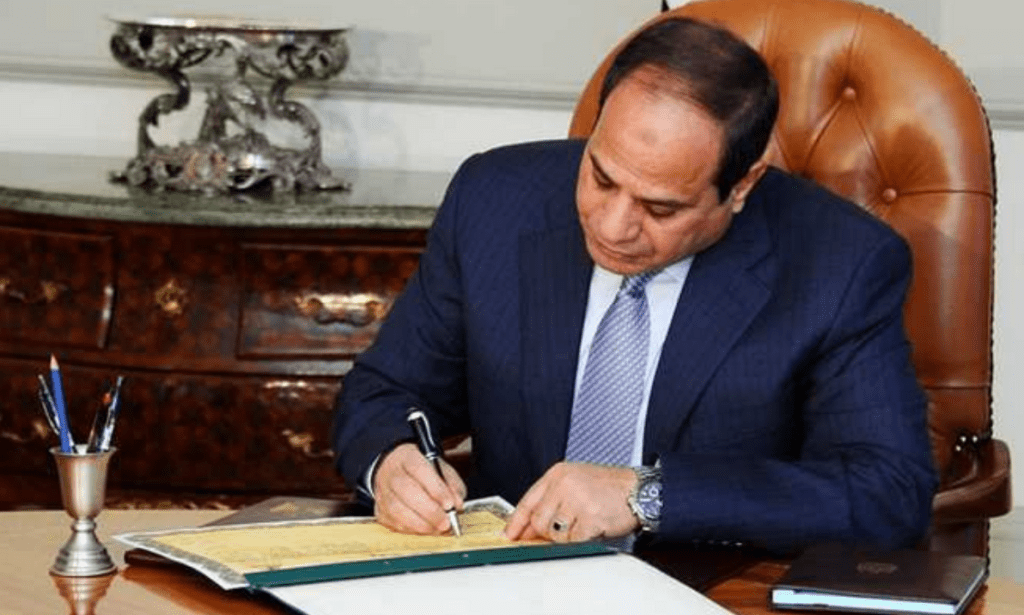

President Abdel Fattah El-Sisi just announced a major change in divorce procedures in Egypt. He approved the Unified Insurance Law, which includes provisions for divorce risk insurance as well as micro insurance for death and permanent total disability.

What Is the Unified Insurance Law?

The Unified Insurance Law addresses insurance and reinsurance activities, as well as related insurance services, professions, and activities. New and comprehensive rules have been established to regulate the insurance industry and expand compulsory coverage.

Under the law, the Financial Regulatory Authority (FRA) will govern insurance activities in the country, including establishing, licensing, supervising, and controlling entities engaged in insurance and reinsurance activities, as well as their related insurance services, professions, and activities.

Some of the new requirements are that insurance companies need a minimum issued and paid-up capital of EGP 250 mn or its equivalent in FX. Those companies will have one year to meet the new capital requirements.

A Look At The New Divorce Risk Insurance Law

Along with the laws governing insurance companies, there are also new laws for marital settlement agreements, aka divorce insurance. According to the Egyptian Financial Regulatory Authority, under the new law, husbands must pay for divorce risk insurance.

The insurance has to be agreed upon before marriage and will differ depending on each case. It is planned to be paid in installments. Once the divorce actually takes place, the insurance payout will be provided to the wife after a specific period.

With all these changes to the insurance laws, a more fair arrangement has been put in place for Egyptian citizens regarding different life scenarios, including divorce and car accidents. The new law also enforces a new compensation rate of EGP 100k for victims of car accidents.