It is important to be informed about the most volatile trading assets in order to avoid trading risks. Volatile assets are those that have a high potential for rapid price changes, which can lead to significant losses if not managed properly. Knowing which assets are the most volatile will allow traders to make more informed decisions and manage their risk accordingly. Being knowledgeable about market movements also helps investors identify opportunities as they arise, allowing them to capitalize on profitable investments while minimizing potential losses due to sudden price fluctuations.

So, if you are involved in the trading market, then this article will be the best supporter, as here we will introduce you to some of the most volatile assets you need to consider before investing. If you are a beginner, we also will outline why you should take into account the level of volatility and why it matters so much.

What You Need To Know About Volatility And Trading Assets

Market conditions are always changing due to the ever-shifting economic landscape and global events. By monitoring market trends, staying informed about current news, and understanding how different factors can affect prices, financial online traders can take advantage of favorable conditions when they arise.

So as the prices are always changing, it is important to have different strategies and tactics for avoiding additional risks. For example, when there is a situation of the bull market, it is even mandatory to use some techniques otherwise, you will lose many opportunities. If you do not know much about this market situation, everything about the bull market explained here and can be used profitably.

For now, you need to be clear about volatile risks. Highly volatile assets can be very risky for financial trading, as the market can move quickly and unpredictably. The most volatile markets are typically found in emerging economies or those with high levels of political instability and currency fluctuations. Additionally, commodities such as oil and gold tend to be more volatile than stocks since they are subject to supply/demand shifts which have a direct impact on their prices. As a result of this volatility, it is important that traders carefully assess the risks associated with investing in these highly unpredictable asset classes before making any trades.

Assets That Were Most Volatile

The list of most volatile assets is created based on a variety of factors, such as market capitalization, liquidity, pricing history, and the amount of trading activity. Additionally, the volatility level is measured by analyzing price movements over time. Factors like news events and macroeconomic conditions can also affect asset volatility levels. Therefore it’s important to consider these criteria when creating a list of the most volatile assets in order to ensure accuracy and reliability for investors who are looking for high-risk investments with potential returns. Here is the top list from 2022.

ROST Stocks

ROST is the most volatile trading asset in 2022 and has the top spot on Nasdaq 100 index due to its high liquidity, strong corporate governance practices, and potential for growth. ROST offers investors a wide variety of opportunities to make money as it is tied closely to consumer spending trends globally.

Additionally, ROST’s stock price often reacts quickly to news or events that have an impact on consumer sentiment which can create large swings in share prices over short periods of time. Furthermore, its low-cost structure and the ability for investors from all walks of life to access it easily through online brokers or investment platforms.

Pinduoduo

Pinduoduo is a Chinese e-commerce platform that allows users to purchase items online at discounted prices. It has become one of the most volatile trading assets in 2022 due to its rapid growth in recent years and its ability to offer customers unbeatable deals on products. The company’s success can be attributed to its innovative business model, which combines social media with traditional e-commerce strategies.

Its unique approach has enabled it to attract more than half a billion active users, making it one of the largest players in China’s rapidly growing digital economy. With such explosive growth potential, investors are beginning to take notice and Pinduoduo is becoming an increasingly attractive asset but only for those who love risk from high volatility.

DocuSign

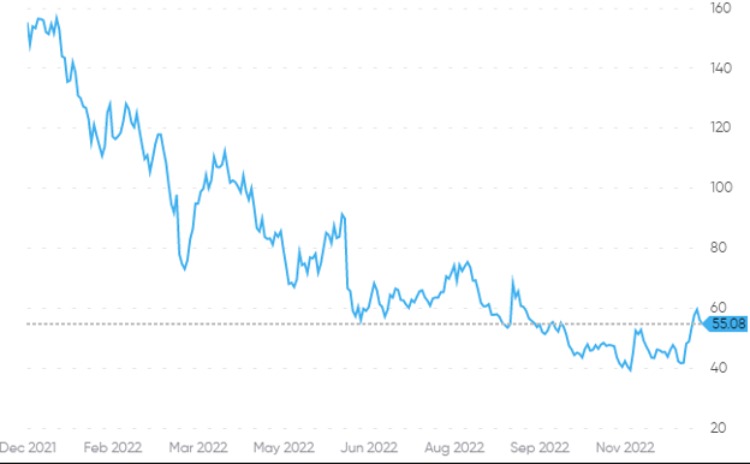

DocuSign became one of the most volatile trading assets in 2022 due to its meteoric rise in popularity and usage. DocuSign’s share price has skyrocketed since it went public in April 2021, making it an attractive option for traders looking to make quick profits from short-term market movements but in 2022, as you can see it was quite unpredictable.

Predictions suggest that the asset will remain highly volatile throughout 2023 as more companies continue to adopt DocuSign services for their digital transformation needs. As such, traders should be aware of potential risks associated with investing or trading this asset over the long term but should also take advantage of any opportunities that arise from its volatility if they wish to benefit financially from doing so.

WE SAID THIS: Don’t Miss…The African Space Agency’s Headquarters Is Set To Make A Landing In Egypt’s New Cairo