The minute you land in Silicon Valley, you discover that there is a secret language that everyone involved with startups (basically everyone in the Valley) uses. If you want to fit in, if you want to talk to potential investors, mentors and advisors, you have to crack this code.

“What’s your burn-rate?”

“We’re operating with a freemium model”

“What’s your MoM growth rate?”

Now I can proudly say that our business is at a 40% MoM growth rate. A few months ago, I wouldn’t have even understood the question.

This is why I decided to dedicate my first “Dispatches From Silicon Valley” post to cracking this secret startup lingo. Ladies and gentlemen, I present to you 15 terms that will help you speak like an entrepreneur.

MVP

Minimum Viable Product, which in simple words means your proof of concept. It can be as simple as a Facebook fan page, a website in beta testing or a prototype. This version of your product is meant to be updated soon after the launch, based on early customer feedback.

Pivot

A change of strategy or business direction based on customer feedback.

Scalability

What’s the growth potential of your product? Does it cater to more than one market? These are the question you need to answer when thinking of scalability. It’s a key term to Middle Eastern entrepreneurs because we need to build global businesses that do not only speak our language.

Bootstrapping

No, I don’t mean it in the software development context. Bootstrapping for a startup means being self-sustainable. You’ll probably use your own money and can also rely on family and friends. This will require you to survive on a low budget until you get your startup off the ground.

KPI

This is not strictly a startup term, but as an entrepreneur you’ll definitely use it a lot. It’s the Key Performance Indicator. It measures your success based on one factor, just one element of your business. It can be the number of paying customers, app downloads or anything else that’s most relevant to your growth at a certain point in time.

But the fun does not end there. Have you heard about OKR? Objectives and key results is a framework from the corporate world closely related to KPIs for defining and tracking objectives and their outcomes. To find out how your business could use OKR software to set structured goals, align activities throughout your organization, track progress, provide feedback, and move everyone in a unified direction, go to profit.co.

Traction

The response to your product in the market. Can be the total number of users, revenue or the amount of investments. It simply means that someone, somewhere found your product attractive.

CLTV (sometimes LTV)

Customer Lifetime Value. It’s simply the net profits that a single customer can provide during their entire relationship with your company. This is usually a prediction based on a forecast of the length of the relationship with each customer, the number of transactions they’ll make and the value of the products they buy.

Freemium

A pricing/marketing strategy. This strategy has been attracting more entrepreneurs lately. It means you give the basic feature for free, then you up-sell other services.

CAC, CPA and CPC

Customer Acquisition Cost, Cost Per Acquisition and Cost Per Conversion. These are three different terms to deliver the same meaning. How much do you pay to acquire one customer? This number must be relative to the CLTV.

Growth Hacking

Marketing through non-traditional and inexpensive ways. It usually depends on finding the key to virality, quick circulation and word-of-mouth.

Burn-Rate

How much money does your company burn monthly? The answer is usually something like, “We’re burning $10,000 per month on salaries, marketing and operations.” This number differs greatly from one company to another and from one market to another. Lucky for us in the Middle East, our burn-rate is usually below the market average in Silicon Valley.

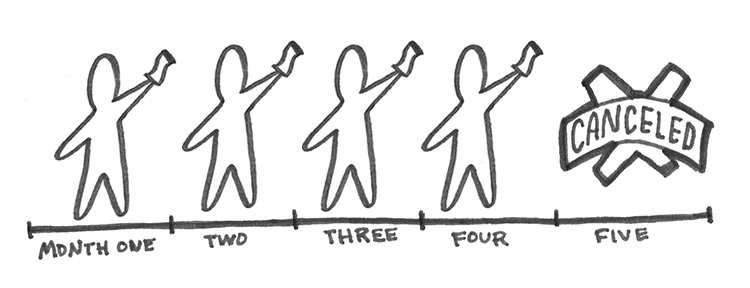

Runway

The amount of time you have until you run out of money, assuming that your spending and income are constant.

WoW, MoM, QoQ or YoY

They all refer to period changes in your company: Week-over-Week, Month-over-Month, Quarter-over-Quarter or Year-over-Year.

Valuation

There are two types of valuations: pre-money and post-money. The pre-money valuation is the value placed on a company’s stock prior to investment, while post-money valuation is based on the amount invested.

Exit Strategy

What will happen next? Who are the potential buyers of your company and why? Or are you planning on going public?

WE SAID THIS: Don’t miss 10 Things to Stop Doing in Your Company in 2015.