Syria’s latest move to incorporate Bitcoin into its financial framework signals both potential and risks for the global crypto sector.

Proposed by the Syrian Center for Economic Research (SCER), the plan is centered on using Bitcoin to stabilize the national economy and draw foreign capital, alongside introducing a digital version of the Syrian pound supported by Bitcoin, gold, and the U.S. dollar.

Introducing Bitcoin into the Syrian Economy

Unveiled on December 31, the SCER’s proposal envisions Bitcoin as a fundamental component of Syria’s economic strategy. The goal is to counter the country’s ongoing inflation crisis while offering a more secure, decentralized alternative to traditional financial mechanisms.

The proposal also explores using Syria’s untapped energy reserves to power Bitcoin mining operations, positioning the country as a potential leader in sustainable crypto mining.

Attracting International Crypto Investment

The SCER sees Bitcoin as a way to open the door to international investment, particularly within the crypto space. By embracing digital currency, Syria could create a more enticing environment for global investors, which could, in turn, help reinvigorate its flagging economy.

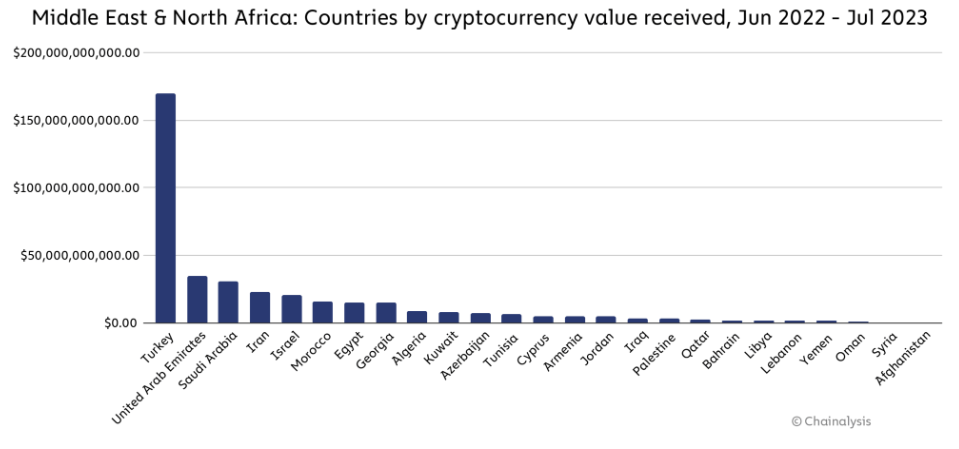

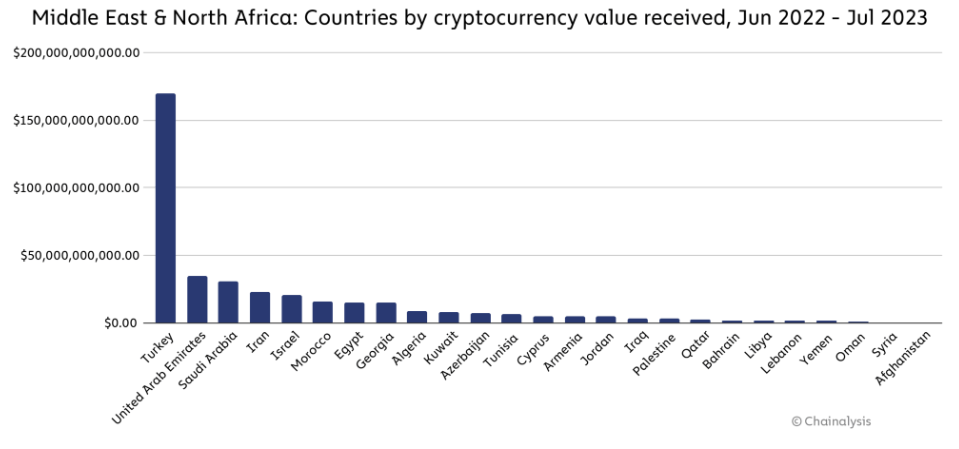

This move aligns with broader global trends where countries are increasingly integrating crypto into their financial systems, enhancing cross-border investment flows.

Transforming Remittance Systems

One of the most significant advantages of integrating Bitcoin could be its impact on cross-border payments. With a large diaspora sending money back to Syria, Bitcoin could provide an efficient and cost-effective method for remittances, potentially reducing fees.

This could improve the remittance experience for Syrian nationals abroad and inspire other nations in the region to consider cryptocurrency as a tool for modernization in payment systems.

The Challenge of Sanctions Evasion

The proposal has sparked concerns due to Syria’s ongoing struggle with international sanctions. While decentralized currencies like Bitcoin offer a way to bypass traditional financial systems, this aspect could raise alarms among regulators and lead to increased scrutiny.

Similar strategies have been employed by countries like North Korea and Iran, leading to questions about whether Syria is seeking to sidestep sanctions through cryptocurrency.

Addressing the Implementation Challenges

Despite the proposal’s ambition, Syria faces substantial obstacles in implementing such a groundbreaking strategy. The country’s fragile technical infrastructure and prolonged economic challenges pose significant hurdles to the widespread adoption of blockchain technology.

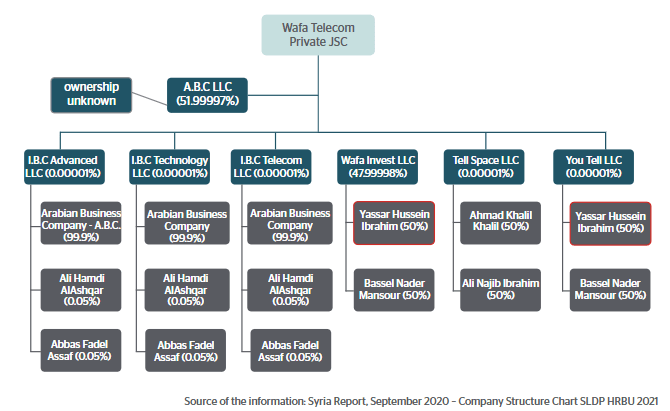

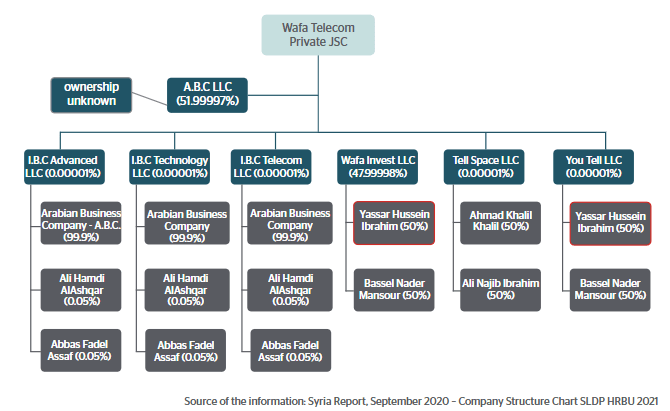

Additionally, there are concerns over the potential misuse of cryptocurrencies by extremist groups, further complicating the situation.

Blockchain’s Role in Financial Evolution

Blockchain technology, the backbone of Bitcoin, promises several advantages for Syria. Its transparent, immutable design can reduce transaction costs and improve compliance by enabling swift detection and blocking of prohibited transactions.

For financial institutions, blockchain offers an opportunity to modernize outdated systems, streamline processes, and enhance security.

Moving Forward with Caution

While Syria’s Bitcoin initiative offers a vision of financial modernization and potential economic stabilization, it comes with complex geopolitical and technical challenges.

The success of this strategy will hinge on Syria’s ability to build the necessary infrastructure, navigate international tensions, and raise public awareness of cryptocurrency’s benefits. How the country addresses these issues will determine whether it can truly leverage Bitcoin to reshape its economic future.

WE ALSO SAID: Don’t Miss… Kingdom Holding’s $400M Stake in xAI Signals Saudi Tech Expansion