Undoubtedly, trading is a game of anticipation that greatly hinges upon thoughtful tactics. To be concise, the Forex market never sleeps, but the knowledge of lucky slots gives you more chances to unleash your trading power and bring you fabulous sums.

Our review today covers the area of South Africa. In this location, Forex session times do not stand out from the crowd. Time is money for your business platform to operate and prosper. In total, there are 4 trading sessions in south africa time based in such megalopolises as Sydney, Tokyo, London, and New York.

There is a consistent pattern that is easy to bear in mind. It all gets cracking during the Asian session, goes on within the European territory, and ends somewhere in America. This allows gold-diggers from diverse time zones to roll up their sleeves and get down to Forex business at their best timing. Moreover, this advantage keeps the marketplace open and available without any broker feeling detached or discriminated against.

Do you have a clue why you need the information about the sessions? How are entries and exits working in practice? Why do people in South Africa stick to particular sessions? Is there any possibility of counting a decent amount of money in my pocket? In this review, we aim to provide you with a deep insight into the matter to make up your solution on Forex trading. Tune in to study more!

What are the peak times available for traders in South Africa?

Previously, we have spoken about the existence of four leading sessions bearing specific names: American (New York), European (London), Asian (Tokyo), and Pacific (Sydney). It is worth adding here that their working time is indicated in Greenwich Mean Time (GMT), so each broker may face a dual challenge attempting to fit it into his schedule.

However, we would like to keep away from describing perfect trading conditions for time and market adjustments. The uncomfortable truth is that the South African Forex market is relatively smaller and less liquid than more mature markets such as the USA or Europe. What’s more, it is also subject to internal economic and political circumstances, which can create a volatile trading environment and result in liquidity risk.

Nobody would like his valuable profit to be dependent on a strange new law or a personal opinion. Thus, South African brokers should be particularly aware of these risks and ensure that they employ strategies to mitigate potential negative effects.

Unfortunately, it is impossible to claim that traders in the South African region are amongst the riskiest players on the market. It happens mostly because the local currency, called South African rand (rand), is classified as exotic. When it comes to this type of currency, it could be added that It has a high spread and low liquidity, so long-term transactions are processed without any references or forecasts for the future.

Predominantly, Wednesday is the best day in terms of profitability leading to successful deals. Although Friday is regarded as a day with boosted volatility, many close transactions at a loss because of this peculiar feature.

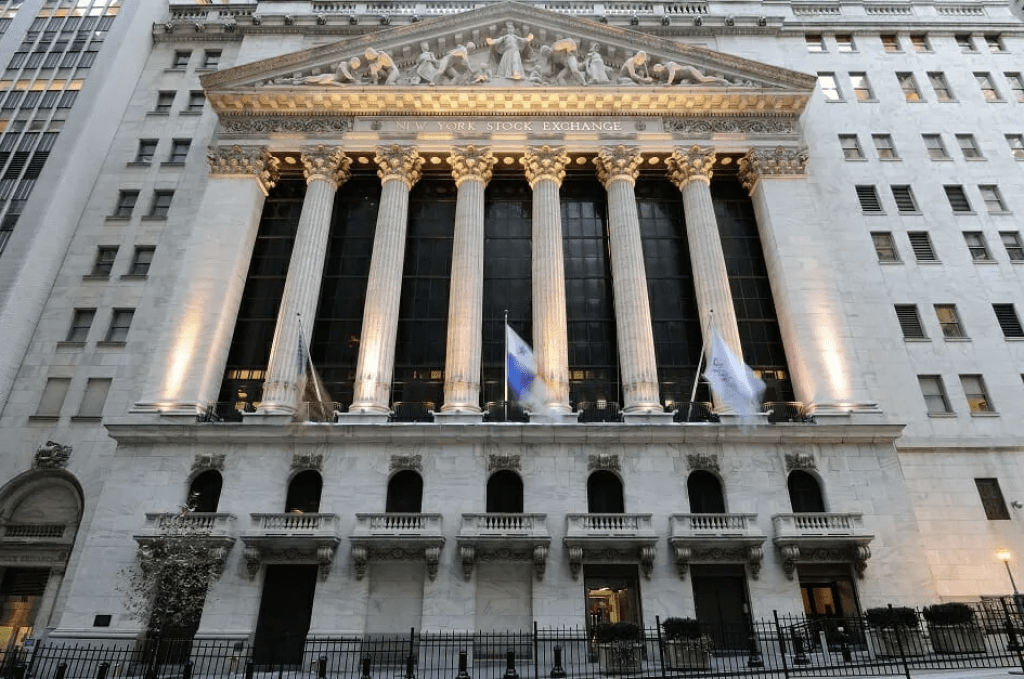

New York Time Frame: A Perfect Time to Show Off

First, the New York Stock Exchange enters into action, and the trading starts at 2 am. To a great extent, the United States is running the show here.

What are the peculiarities of American session market hours? Being highly volatile, this session offers great trading options using the most appealing currencies such as the pound sterling, euro, Australian dollar, and US dollar. At the end of this time frame, everything calms down, as volumes subside and price action slows drastically as Sydney joins in.

Tokyo Time Frame: When a Heart Skips a Beat

Named as an Asian session on everyone’s lips, this session with its a slow pace in price alterations. During this period, spreads on most marketplaces regularly widened during this time. Due to relaxed price moves and cash volatility, this type of session is looked upon by many brokers.

The bonus opportunity can be added here: one does not need a crystal ball to predict the price movement during this session. The Tokyo time frame starts at 1.00 AM and is ready for closure at 9.00 AM SAST.

London Time Frame: Trading at a Full Swing

Highly vibrant and competitive, this time frame can offer the most cash and rapid alterations in the price policy. However, a snake in the grass is hidden among this beautiful financial landscape. Don’t forget that volatility can work both for and against your needs within this time. When the price moves quickly, it is complicated to predict any move; therefore, entering positions becomes quite challenging, especially for a newbie.

If you get the swing of the London session, you will adore its volatility perks. The most successful currencies are believed to be GBP, USD, and EUR. Let’s bear in mind that all trading characteristics fade away closer to the end of the time frame around 6:00 AM SAST.

Sydney Time Frame: Flexibility and Openness

Truly, the Sydney session is the fussiest season for all brokers worldwide. Let’s imagine it: the market opens up for traders at 11:00 AM SAST sharp. While Sydney cannot boast of its size compared to the others, it can impress even a top-notch dealer with its impressive volatility, particularly after the brief pause. It is high time for a broker to shine with flexibility.

Can any Forex session in South Africa lead to immediate results?

All in all, it must be realized the type of currency pair you are interested in experimenting with. What does it mean in the core? Diverse money pairs fluctuate in different ways throughout the day. That’s why the ideal time to trade is between 9:00 AM and 10:00 PM SAST. During these time frames, you can show off your picky side and select the currencies you would like to trade with.

South Africa has a favorable geographical location, thus, a good pennyworth occurs by the light of the day. It means that you get a lot of nerve to trade when the price is most capricious. The leading disadvantage of taking a position at night is not a lack of normal sleep. It means that as a Forex broker, you have to deal with huge spreads which are a well-familiar obstacle that is not that easy to overcome, even for the best Forex players.

WE SAID THIS: Don’t Miss…Sculpting A New Narrative: Jan Ernst Teams Up With Kahhal1871 For Upcoming Collab