There’s always a learning curve for being an adult because for all the fundamental information that schools teach their students, everyday essentials from finances to lending to borrowing to credit scores are often left for you to figure out on your own. Thankfully, there are a lot of resources online to help you understand what your options are and what you have to do to get what you want. Unfortunately though, there is also a lot of misinformation online that has led to plenty of myths being commonplace when it comes to credit scores.

To help you understand credit scores a bit better, here are the top myths of today and what your options really are:

Checking your credit report hurts your credit score

This is possibly one of the biggest myths out there, but the fact is the type of credit report you would be looking at will not impact your credit score in any way. This is because the credit report you look at is considered a “soft search.” It’s your responsibility to check your credit report at least once a year to understand where you are at and what you can do to improve it further. As CNBC points out, the only time a credit check will impact your credit score is when you actually apply for a credit card or loan and get rejected, and even then, it is only a temporary issue.

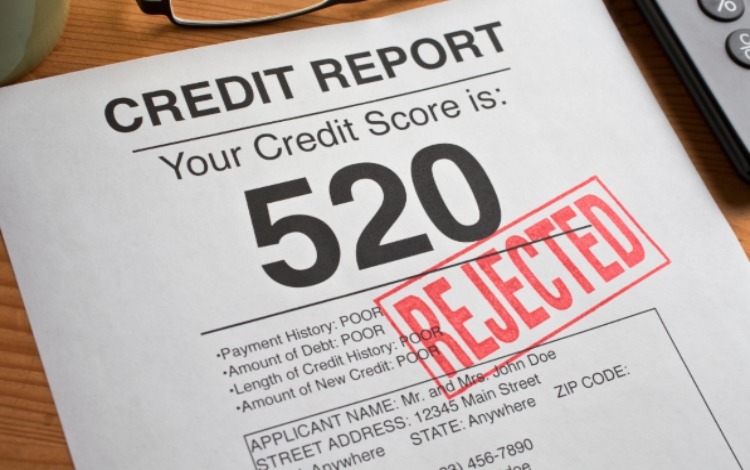

It’s impossible to rebuild your credit score

Of course it is possible to rebuild a poor credit score! Just as you can build your credit score from something that is okay into something great, you can also pull your credit score out of the murk. You may need to work with a credit advisor to do this however, depending on your credit score and level of debt. If you don’t have debt, for example, then you can get started with a credit building loan that is explicitly designed to help increase your credit score to a point where you can start to apply for credit cards, loans, etc.

You cannot get a loan without a credit score

The first big myth being busted today is that you cannot get a loan with a credit score or history. To start, everyone, even if they have never taken out a loan or had a credit card, will have a credit score – they just won’t have a comprehensive credit history. Not being in debt gives you a baseline credit score, but you will want to build it up to have access to the best rates and deals when applying for loans, credit cards, and mortgages.

The other half of this myth is that you cannot get a loan with a bad credit score. A spokesperson for bad credit loan website CashLady busted this one for us: “There are loan options out there for those with poor credit, especially if your goal is to build up your credit score and history. The interest rate will be higher, but as long as you manage the money responsibly and meet all your repayments a loan can actually improve your credit position for the future.”

Your education level can affect credit score

Your education level has no bearing on your credit score. Not being able to make student loan repayments, however, can impact your credit score. Similarly, those who have student loans who do make each repayment on schedule will automatically have a credit building opportunity that those who have not gone to university or alternatively paid for their degree out of pocket will not have.

Credit is a sure-fire way to get into financial trouble

Credit abuse can get you into trouble, but credit is perfect for helping you save money in the long run. That is why it is important to use credit like credit cards, even when you have the money in the bank to easily pay for your items. In fact, this is the best way to use your credit cards, as it makes it easy to repay your debt in time so that you can build the trust lenders have in you, making it easy to apply for more loans and even mortgages.

Bankruptcy protection is perfect if you have a lot of debt

Bankruptcy is an option if you have scores of debt and have no way to get out of it, but it is a mistake to assume it is an easy solution. Bankruptcy remains on your credit report and can severely impact your ability to borrow money, though it is possible to rebuild your score.

How long bankruptcy stays on your report depends on where you are located. In the USA, it remains on your report for 7-10 years, depending on which method you used to declare bankruptcy. In the UAE, the average is five years. In the UK, the average is six, and in other places like India, it only remains for three years.

You only have one credit score

This is false! The fact is that every lender will have different considerations when determining the credit-worthiness of a customer. There is not just one credit score that every creditor looks at when determining if you are a good candidate; all the good lenders will at least conduct their own custom credit score. This credit report will be tailored for the type of loan or business that you are lending for.

Negative information is erased from your credit report after you pay it off

Unfortunately, you don’t get a clean slate when you finally manage to repay an outstanding payment. This information, along with collection accounts and, of course, bankruptcy, remains on your credit report for around 10 years. That doesn’t mean that there isn’t a reason to pay off your debt, as your account will note that the debt will have been “paid” which can help you rebuild your credit score and history before that 10-year mark.

It’s better to never use credit

While abusing your credit and going into debt is a sure-fire way to hurt your credit score, using cash and never buying anything on credit doesn’t help either. It is certainly better than being in debt, but it doesn’t allow creditors to see or build your credit score and history. Being a responsible borrower is the best option to help you get the best rates and access to credit loans that you would otherwise be excluded from.