The Strait of Hormuz Explained: What’s at Stake in the Iran-Israel Conflict

The Strait of Hormuz is back in the headlines. As tensions between Iran, Israel, and the United States hit new highs, fears are growing that Iran could shut down one of the world’s most critical oil routes. That move would send global energy markets into chaos and rattle economies. Here’s what’s at stake.

What Is the Strait of Hormuz?

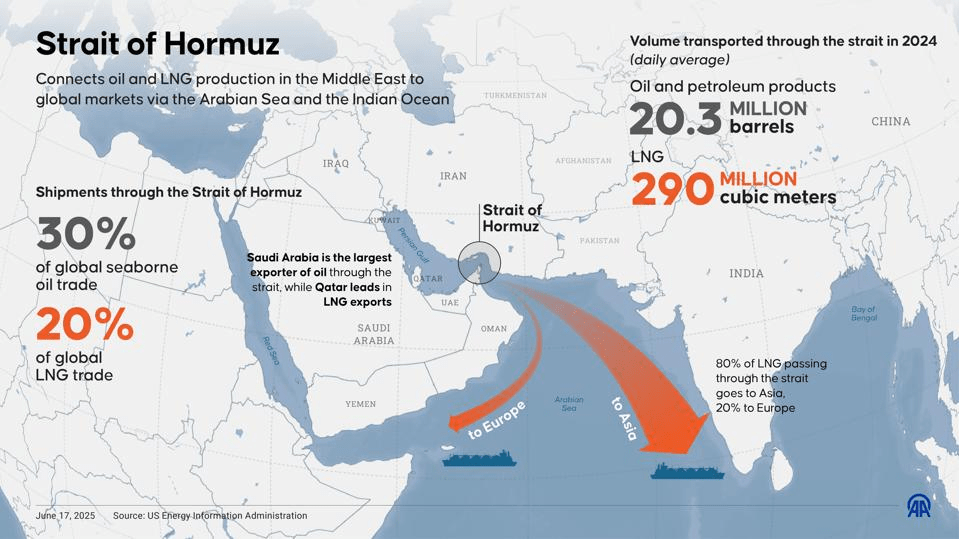

The Strait of Hormuz is a narrow waterway—just 21 miles wide at its tightest point—that connects the Persian Gulf to the Gulf of Oman and the Arabian Sea.

Why Is the Strait of Hormuz That Significant?

It’s the only sea route for oil exports from the energy-rich Gulf region. That’s why it’s considered one of the most strategically vital chokepoints in the global economy.

Major exporters like Saudi Arabia, Iraq, the UAE, Kuwait, Qatar, and Iran rely on it to ship crude oil and liquefied natural gas to global markets, especially Asia.

Roughly 20% of the world’s daily oil supply—about 20 million barrels—passes through it every single day.

What’s Pushing Iran Closer to Closing the Strait?

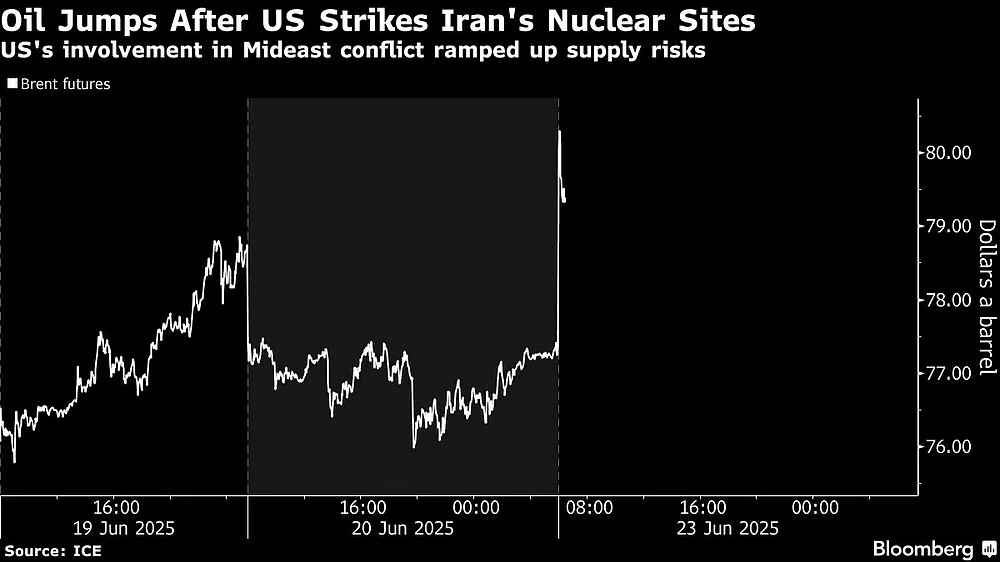

Tensions in the Middle East have flared up after Israel, and then the United States, launched airstrikes on Iran’s nuclear sites. In response, the Iranian parliament voted to close the Strait of Hormuz.

The vote has escalated global fears. While the final decision rests with Iran’s Supreme National Security Council, Iran’s decision to shut the strait is not unlikely.

How Did The Threat of Closure Affect Global Markets?

Despite the vote, the Strait of Hormuz remains open for now. But global oil markets are reacting. Oil prices spiked by nearly 10%, with Brent crude briefly surpassing $80 per barrel, its highest since January.

Expected Global Impact: Oil Prices Spike and Economic Inflation

A closure would choke off the main artery of global oil and gas trade, sending energy prices through the roof. Asian economies like China, India, and Japan—which depend heavily on Gulf oil—would be hit the hardest. Europe, already grappling with energy issues due to the Ukraine war, could face a deeper crisis.

Analysts warn that if Iran follows through and blocks the strait, prices could soar toward $100 or even $110, depending on the scale and duration of the disruption. A price surge of $25 in one go would be a major shock to a global economy unaccustomed to such abrupt shifts.

Beyond oil, the strait is also a key shipping route for global trade. Blocking it would raise shipping costs, delay cargo, and add pressure to global supply chains, pushing inflation and potentially triggering a worldwide recession.

Such a move could also prompt intervention by global powers to keep the waterway open, raising fears of a broader regional escalation.

Egypt: Limited Trade Impact, But Still Vulnerable

Experts believe Egypt won’t feel the direct effects of a Hormuz closure in terms of trade, since it doesn’t rely on the strait for imports or exports. However, a rise in global oil prices could affect Egypt’s budget and put additional pressure on public finances.

So far, economists think the risk for Egypt is short-term and manageable, especially since Iran hasn’t actually closed the strait. Egypt also has strategic reserves of essential goods and energy to weather temporary disruptions.

What Happens Next?

For now, the world is holding its breath. Iran’s threats could remain just that—or they could spiral into a major disruption with global consequences. A full closure of the Strait of Hormuz would deliver a serious blow to the global economy, especially countries in Asia and Europe.

Egypt may not be at the center of the crisis, but it is feeling the effects, from rising oil prices to regional instability.

WE SAID THIS: Don’t Miss…Inside the US Strikes on Iran’s Nuclear Sites: The Story So Far