By Malak Khaled

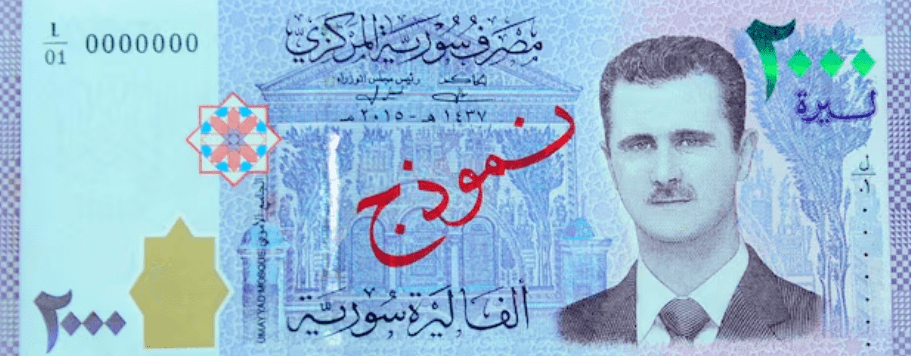

The Syrian pound has strengthened significantly—by at least 20%—against the U.S. dollar, driven by political and economic changes following the fall of the Assad government. Exchange rates are reported to fall between 10,000 and 12,500 Syrian pounds to the dollar, compared to the earlier rate of 15,000.

So what has factored into this positive economic change, and what is expected in the short term for the Syrian pound?

What Changed Economically?

Since 2020, the Syrian pound has lost over 90% of its value in the parallel market. It had fallen a sharp 141% in 2023 alone, the worst record in its history. The Central Bank repeatedly devalued the official exchange rate last year, but it remained far below black-market rates, reflecting severe economic instability.

With the fall of the Assad regime, thousands of Syrian refugees are returning from Lebanon, Türkiye, and Jordan. The return of refugees to Syria brings back savings and injects foreign currency into the economy.

There has also been an easing of restrictions on foreign currency use in everyday trade. Previously, Syrians risked imprisonment for using or even discussing foreign currencies openly. This newfound flexibility has played a significant role in strengthening the Syrian currency over the past few days.

Hope for the Future

Analysts believe the pound’s future will depend on the new government’s ability to manage reconstruction, attract foreign investment, and restore oil exports. Infrastructure rebuilding, supported by neighboring countries, could revitalize sectors like real estate, construction, and tourism.

However, Syria is still facing many challenges. With over 90% of Syrians living below the poverty line and key industries like oil and manufacturing devastated by years of war, rebuilding efforts will not be easy.

Syria’s new government aims to stabilize the economy by raising wages by 400%, unifying factions, and prioritizing public services.

What Threats Is the Syrian Economy Facing?

The country is facing risks of fragmentation. The political transition could be difficult due to rival factions, which might undermine economic recovery efforts.

Syria also faces threats from neighboring countries, with risks of Israel potentially expanding its occupation into additional parts of the Golan Heights, according to the BBC.

Since stability is important as a prerequisite for sustained currency improvement, these factors are all expected to affect the Syrian pound rate.

A rocky time is expected for the Syrian Currency as the new government works to stabilize power and implement reforms. While successful political transition and reconstruction could lead to recovery, uncertainty remains high in the short term.

WE ALSO SAID: Don’t Miss…Protected by Moscow: Assad’s Asylum and Russia’s Refusal to Extradite