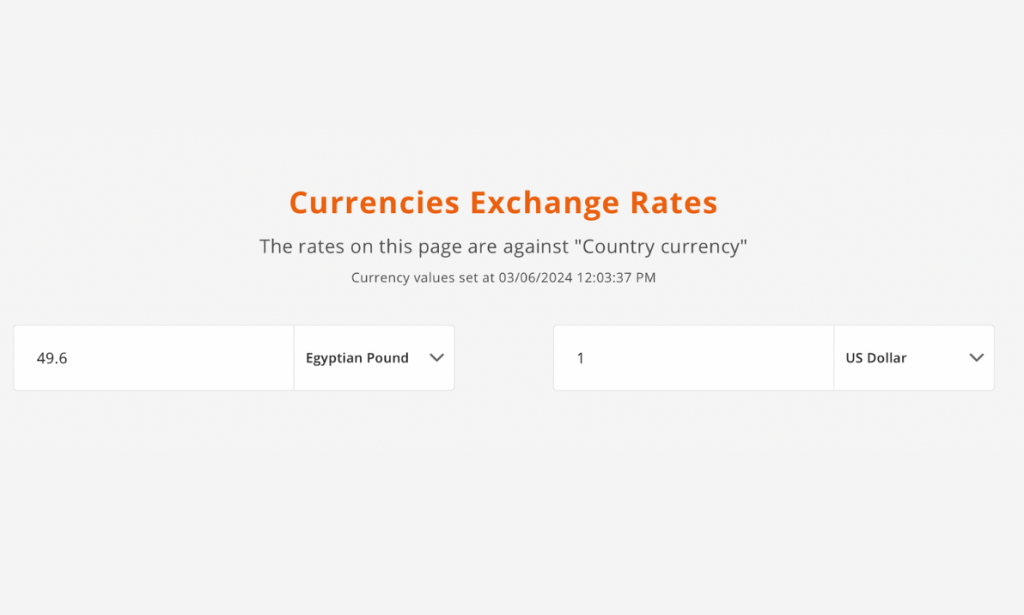

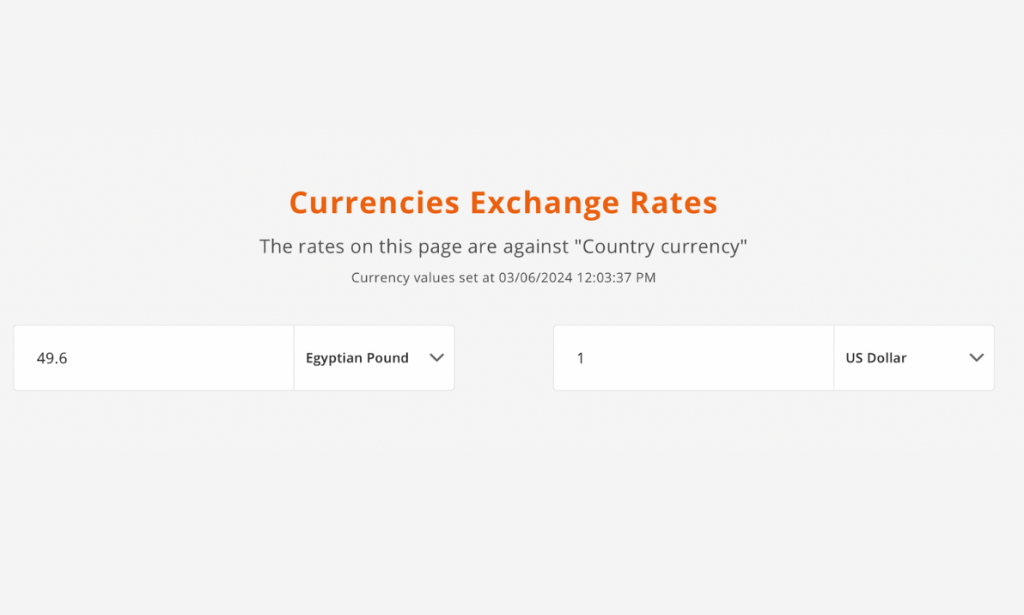

The Central Bank of Egypt (CBE) made a major decision concerning the exchange rate in the country. It has devalued the Egyptian pound and decided to have the exchange rate determined by market forces and supply and demand.

The decision came into play just after the CBE raised the interest rate by 6% as a way to combat persistent inflation and unify the country’s exchange rate.

The overnight deposit rate was raised to 27.25%, the lending rate was raised to 28.25%, while the the main operation rate was raised to 27.75%. Shortages in foreign exchange, a weakened currency, as well as global inflation pressures are all reasons behind this increased interest rate.

The change in exchange policy involves a push for a unified exchange rate to help eliminate foreign exchange backlogs. Through a single market-driven rate, operations will be streamlined across the country.

This is a major leap from Egypt’s usual exchange policy, and it showcases the CBE’s commitment to applying measures that can help stabilize the economy.

It’s also worth mentioning that the price of the dollar increased across many banks in Egypt, including Alex Bank, NBE, and others.