By Omar Gouda

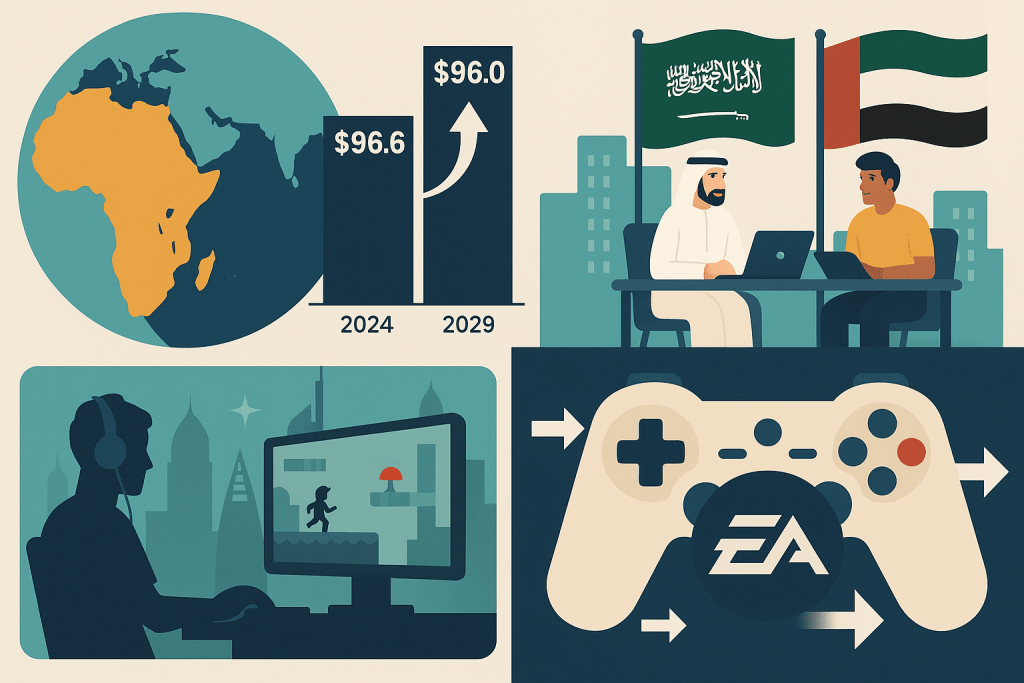

The Middle East & North Africa (MENA) and Asia’s gaming markets together generated $86.6 billion in player spending in 2024, with revenue projected to reach $96.0 billion by 2029. The trend is being spearheaded by Saudi Arabia and the United Arab Emirates, which have moved from being largely consumers to strategic hubs of investment, development, and acquisition. Also, the recent takeover of Electronic Arts (EA) by a Saudi-led consortium marked a defining moment for the region.

How It All Started

The gaming sector started sprouting in the MENA region more than two decades ago. One of the region’s early game studios was Maysalward, founded in Jordan in about 2003, which focused on combining local cultural elements with gameplay and collaborating with European partners.

By the mid-2010s, the UAE and KSA had begun to formalize infrastructure: hosting international esports events, building regulatory frameworks, creating startup accelerators, and supporting local game studios. In KSA, incubation programs like those operated by Nine66 (a part of Savvy Games Group) started helping fledgling studios scale.

KSA & UAE are Engines of Growth

Saudi Arabia, through its sovereign wealth fund PIF, has established Savvy Games Group, a subsidiary that invests in, develops, publishes, and supports game studios. KSA’s megaproject NEOM has also launched its Level Up Accelerator, supporting startups (e.g., Starvania, Fahy Studios) in securing international publishing deals and nurturing local talent.

The number of gaming startups in KSA nearly doubled from 13 to 24 between 2021 and 2022. Most studios remain small (1-10 people), though a growing number exceed 10 staff as they scale.

Over in the UAE, companies like Galaxy Racer, MyWhoosh, and Esports Middle East (ESME) have made strong strides in esports and competitive gaming.

The Game-Changing EA Acquisition

A major milestone in the region’s gaming ascent came with Electronic Arts’ (EA) acquisition. Just last month, the company revealed that it had reached a definitive agreement to be purchased by a consortium led by Saudi Arabia’s Public Investment Fund (PIF), alongside Silver Lake and Affinity Partners, in an all-cash transaction valued at $55 billion.

Analysts see this acquisition as part of Saudi Arabia’s broader strategy to become a global hub in gaming and esports, to diversify the economy away from oil, and to build cultural industries and entertainment sectors. The move gives Saudi entities potential leverage in content creation, licensing, esports infrastructure, and international partnerships.

The Market Side

While exact asset valuations in KSA and the UAE’s gaming industries are not publicly available, indicators suggest significant financial depth. Savvy Games Group, which oversees multiple subsidiaries, employs thousands and manages multi-billion-dollar investments in both domestic and global companies.

Meanwhile, both Riyadh and Dubai have invested heavily in esports arenas, world-class gaming events like Gamers8, and education programs to train developers and designers.

Improved digital payments, Arabic localization, and local content production are key factors that could allow Gulf markets to capture a disproportionately large slice of future global spending.

Catalysts for Growth

Several powerful forces are propelling MENA’s gaming ascent, with Government support remaining the most visible.

Saudi Arabia’s National Gaming and Esports Strategy, launched under Vision 2030, aims to make the Kingdom a global gaming hub, targeting 250 gaming companies and 39,000 industry jobs by 2030.

The UAE has adopted a similar policy stance, integrating gaming into its digital economy agenda and encouraging private-sector participation. Reforms in intellectual property laws, content ratings, and digital media regulations are creating a clearer, investor-friendly environment.

Challenges Ahead

Despite impressive progress, the MENA gaming sector faces meaningful challenges. Monetization remains a major hurdle, with payment infrastructure and credit accessibility still lagging behind more mature markets.

Cultural and regulatory sensitivities can also constrain content: certain global titles face bans or age restrictions, forcing publishers to adapt or delay releases.

The talent pool, though expanding, remains thin at the senior and technical levels. Many studios struggle to scale due to limited access to experienced producers and international mentorship.

Intense competition from established global gaming centers in East Asia, North America, and Europe requires that the MENA region differentiate itself. Rather than trying to replicate existing global successes, the region needs to leverage its strengths by focusing on localized content and compelling regional storytelling.

The Way Forward

The EA acquisition marks a powerful step for the MENA gaming sector. It shows regional investors can successfully compete for major global IPs and confirms their intent to steer the future of the industry.