The startup ecosystem in the Middle East and North Africa (MENA) region witnessed a significant slowdown in October 2024, with total funding dropping by 52% compared to the previous month.

According to Wamda’s Nesma Abdel Azim, startups across the region raised only $134 million, marking a 13% decrease from the same period last year. This decline follows a strong performance in the third quarter, which saw substantial investments and a notable recovery in the region.

Regional Leaders: UAE and Saudi Arabia

Despite the overall drop, the UAE remained a leader in the MENA startup ecosystem, raising $61.8 million across 15 deals, making up nearly half of the total funding raised in October.

Saudi startups were close behind, securing $50 million through 21 deals. The UAE and Saudi Arabia’s dominance in the region reflects their ongoing startup investment strength.

Kuwait also made a notable appearance in October, thanks to the proptech company Sakan, which raised $12 million as part of the $13.5 million secured by Kuwaiti entrepreneurs.

Meanwhile, Egypt, which has faced ongoing economic challenges, saw a dramatic decrease in its funding levels, with only $1.6 million raised by eight startups in October, down significantly from the previous month.

Proptech Overtakes Fintech in October 2024

In a surprising turn, proptech emerged as the top-funded sector in October, surpassing fintech, which had been the dominant sector for most of the year.

Proptech startups attracted $38 million across five deals, driven largely by Sakan’s successful fundraising. This shift indicates growing investor interest in property technology, which has benefitted from the ongoing digital transformation in real estate.

Fintech, traditionally the most funded sector in MENA, fell to second place in October, securing $26.4 million across six deals. Despite this, fintech remains a strong contender, reflecting investor confidence in the region’s growing digital financial services.

Other sectors, including e-commerce and edtech, also saw significant investments. E-commerce startups raised $14.6 million across four deals, while seven edtech startups secured $11 million, signaling continued confidence in online education.

The Rise of Female-Funded Startups Amidst the Funding Decline

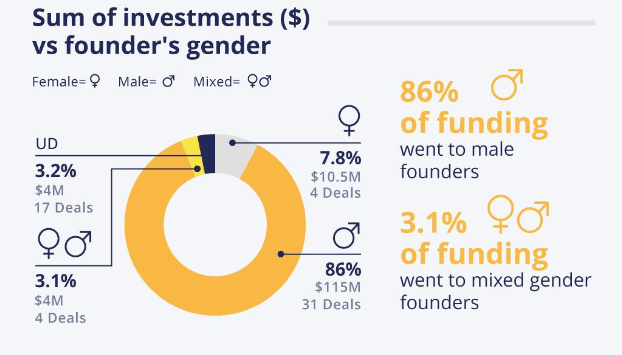

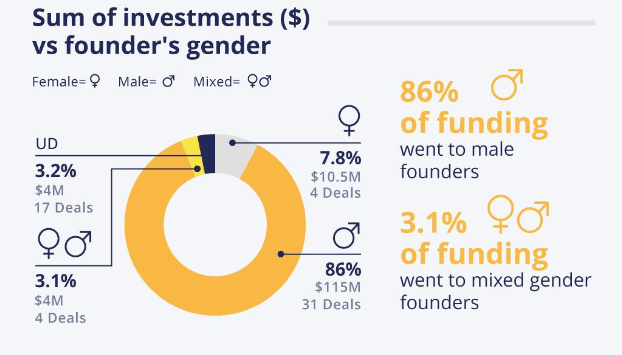

A notable development in October was the increase in funding for female-founded startups, which secured $10.5 million, a positive sign for gender inclusivity in the MENA investment landscape.

This was a significant rise compared to previous months, though male-founded startups still dominated the funding scene, raising $115 million. Nevertheless, the increase in investments for female-led firms suggests a growing focus on diversity and inclusion within the region’s venture capital ecosystem.

The Future Outlook: A Resilient Ecosystem Amid Uncertainty

While October’s funding results reflect a slowdown, the MENA startup ecosystem remains resilient. The downturn follows a record-breaking Q3, where total investments reached $727 million, driven by strong performances in sectors like fintech and Web3.

Despite geopolitical tensions and economic uncertainty in some countries, investors continue to see potential in MENA startups.

Looking ahead, the region’s venture capital landscape is expected to maintain its growth trajectory, with local investors continuing to support early-stage startups. As the global economy grapples with uncertainty, the MENA region’s startup scene has proven its ability to weather storms, making it an attractive market for both local and international investors.

We Also Said: Don’t Miss It…Middle East Tourism Booms: Visitor Numbers Double in Just Five Years